To view this letter in PDF Format lease click here: 2025-Q1 PBCM Investor Letter.pdf

Welcome to our new investors and thank you to our existing clients and partners for your continued support. We are pleased to present our results for the most recent quarter in the following pages.

After reading this letter, please do not hesitate to contact us if you have any questions, want to discuss any topics in greater detail, or would like to learn more about our Concentrated Value portfolio. We can be easily reached via e-mail at info@pelicanbaycap.com. We welcome your feedback and look forward to your correspondence. Additionally, we encourage you to share this letter with your friends and colleagues.

Equity markets have corrected sharply in recent weeks, accompanied by a surge in volatility. The S&P 500, for instance, dropped as much as 19% from its February 19th peak. Notably, during the first 15 trading days of April, the S&P 500 experienced daily moves exceeding 2% on seven occasions. The VIX Volatility Index spiked to 60 on April 7th, a level historically indicative of severe market panic, and has since remained elevated above 30.

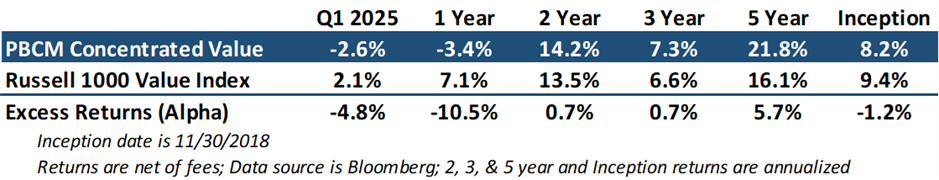

While market stress understandably concerns many investors, in turbulent markets periods our value-oriented approach has historically delivered strong outperformance compared to the broad S&P 500 Index and our benchmark, the Russell 1000 Value Index.

Interestingly, the Concentrated Value portfolio began the year trailing its benchmark through late February, continuing a pattern of seemingly daily losses observed in November and December of the previous year. However, as market volatility intensified in late February and equity markets declined sharply, the portfolio began to outperform again, a trend that has continued into April.

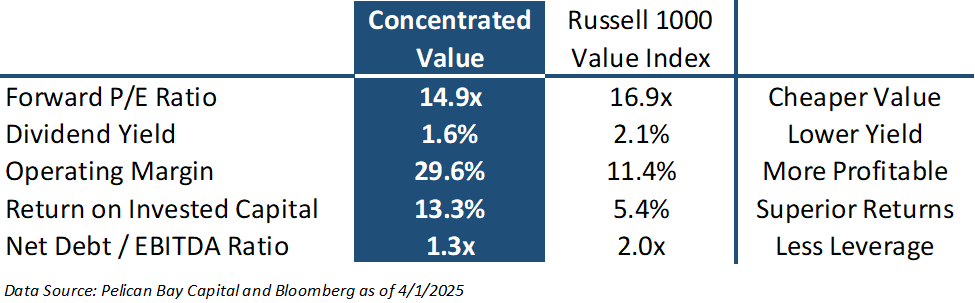

We believe our relative outperformance in negatively trending markets is attributable to the portfolio’s focus on high-quality companies with robust balance sheets, characteristics that investors favor during periods of heightened volatility. As you can see from the table below, the Concentrated Value portfolio has companies with superior operational metrics and less financial leverage than the average company in the Russell 1000 Value Index.

More importantly, market corrections also present valuable opportunities for portfolio managers to enhance their portfolios with better investment prospects. The ability to recycle funds into beaten-down companies lays the groundwork for sustained outperformance into the subsequent market recovery. Our historical trading activity reflects this, with the Concentrated Value portfolio typically experiencing the most turnover during periods of market stress, including the Covid pandemic, the 2022 Russian invasion of Ukraine, and the Silicon Valley Bank Crisis in March 2023.

We have increased our cash position heading into the quarter’s end and are actively seeking new investment opportunities. Furthermore, some current holdings, such as Verizon (ticker: VZ), CBOE Global Markets (CBOE), and CME Group (CME) are trading at the higher end of their fair value and have appreciated during the recent selloff. These positions are potential candidates for swaps into new investments. While we remain confident in our current portfolio, we are also eager to capitalize on opportunities presented by quality companies affected by market turbulence.

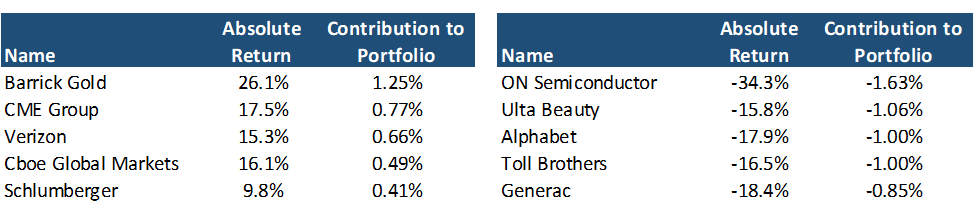

Regarding individual stock performance this quarter, the top contributors to our return were, unsurprisingly, Barrick Gold (GOLD) and the previously mentioned Exchange companies, CME and CBOE. It is also worth noting the absence of Consumer Staples, Utilities, and Healthcare companies. These were the best performing sectors during the quarter and our lack of any positions in these industries was a big reason for our underperformance versus our benchmark this quarter. A list of the portfolio’s top contributors and detractors can be found in the table below.

Our largest detractors were our more cyclical holdings, including On Semiconductor, Ulta Beauty, and Generac. Their underperformance is primarily a result of the diminished economic outlook in the first quarter due to heightened policy uncertainty from President Trump’s efforts to reduce government spending and increase tariffs. To mitigate this impact, we reduced our larger, economically sensitive positions in Expedia Group (EXPE) and Corpay (CPAY).

In January, we exited our position in Berkshire Hathaway on success. The shares were trading significantly above our estimated intrinsic value, and we needed to create capacity for a new investment in Royalty Pharma (RPRX), as the portfolio was at its 20-position limit.

Royalty Pharma funds promising drug candidates in early clinical stages by purchasing royalties, which represent a percentage of future sales once these drugs reach the market. RPRX holds a unique position as the only publicly traded pharmaceutical royalty company. It went public in 2020 during the pandemic and has been largely overlooked, likely because its business model contrasts sharply with other pharmaceutical peers.

This neglect is surprising, as royalty businesses are generally favored in other industries due to their high margins and stable recurring revenue streams. What makes RPRX even more attractive is its dominant position within the drug royalty industry. Holding a significant 56% market share, it is the leading acquirer of biopharmaceutical royalties.

RPRX is often the first call for pharmaceutical companies seeking funding. For larger royalty transactions exceeding $500 million, the company faces virtually no competition, establishing it as the primary partner for drug companies looking to monetize their drugs to alleviate the financial burden of expensive Phase 2 and 3 clinical trials.

This “first call” status grants RPRX access to the most promising and lucrative opportunities, further strengthening its already robust portfolio. Notably, RPRX has funded 15 royalties that ultimately became blockbuster drugs, each generating over $1 billion in annual sales.

RPRX Management has a 28-year track record of selecting winning drug candidates that has generated returns in the low teens and compounded royalty revenues by 13% annually. They possess a keen eye for identifying therapies with strong market potential. This proven track record instills confidence in the company’s ability to grow their royalty stream well into the future.

Despite its strong market position and history of delivering attractive investor returns, the stock had been trading around $30 per share, representing a price-to-earnings ratio of just 5-7.5x based on our estimated normal earnings power of $4 to $6 per share.

Our analysis suggests that the existing royalty stream from drugs currently on the market is worth between $35 and $41 per share alone, offering a significant margin of safety. When factoring in their pipeline of royalties on drugs still in clinical trials and future growth prospects, we believe the intrinsic value of RPRX lies within a range of $40 to $78 per share. This indicates substantial upside potential from our initial purchase price of $30 per share.

Lastly, we wanted to revisit the Investment Philosophy of the Concentrated Value portfolio. We utilize a value investment strategy that seeks out companies for investment which the Portfolio Manager deems to be high quality companies. Quality is defined by possessing business operations with durable competitive advantages, allowing for high returns and growing cash flows streams. We want these high-quality companies to also have solid balance sheets, preferably with a net cash position. We also prefer that their management teams make decisions with an emphasis on maximizing shareholder returns.

Once we find these high-quality companies, we generally only invest in their stock if they trade at a steep discount to our estimate of their intrinsic value. This is necessary to provide our investors with the opportunity to generate an above-market return and protect capital. This discipline creates a wide margin of safety if an undesirable scenario plays out in the future. Pelican Bay Capital Management believes that identifying a significant difference between the daily market value of a security and the intrinsic value of that security is what defines an investment opportunity.