To view this letter in PDF Format lease click here: 2024-Q4 PBCM Investor Letter.pdf

Welcome to our new investors and thank you to our existing clients and partners for your continued support. We are pleased to present our results for the most recent quarter in the following pages.

After reading this letter, please do not hesitate to contact us if you have any questions, want to discuss any topics in greater detail, or would like to learn more about our Concentrated Value portfolio. We can be easily reached via e-mail at info@pelicanbaycap.com. We welcome your feedback and look forward to your correspondence. Additionally, we encourage you to share this letter with your friends and colleagues.

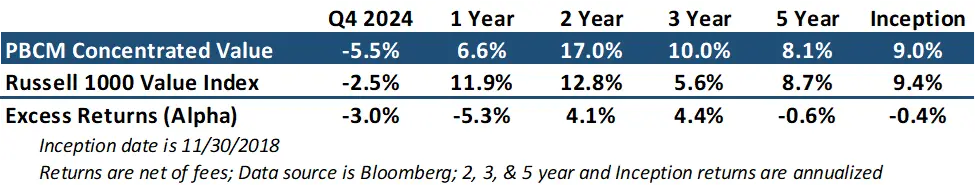

The fourth quarter presented a formidable challenge for portfolio managers, as market breadth narrowed considerably. Investor focus became fixated on the so-called “Magnificent Seven” and companies associated with the burgeoning field of Artificial Intelligence. Having drawn level with our benchmark in early October on a year-to-date basis, the Concentrated Value portfolio subsequently relinquished ground almost daily against the Russell 1000 Value Index. Ultimately, we underperformed our benchmark by the widest margin since the first quarter of 2020.

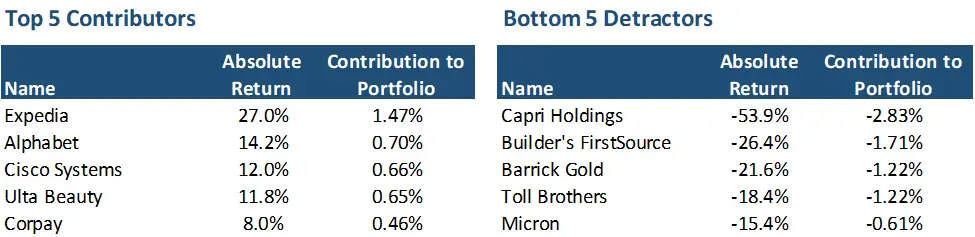

Of course, when you lag the market by 5% over a two-month period it also requires mistakes by the portfolio manager, and we made a meaningful unforced error. In our case, we made a miscalculation regarding the Federal Trade Commission’s antitrust challenge to the proposed Capri Holdings (CPRI) and Tapestry (TPR) merger. This misjudgment subtracted 2.8% from our relative performance, a regrettable loss of capital, yet a very valuable lesson for the future.

As we wrote in our prior letter, we were concerned that the Judge overseeing the FTC lawsuit to block the merger would show special deference to the Government in deciding the case, as she was a relatively new Biden Appointee, and this was her first Anti-Trust Case.

Despite what we thought was overwhelming evidence presented at trial that invalidated the FTC’s core argument, and what could best be described as poor performance from the FTC’s star anti-trust expert, the Judge ruled in favor of the Government. We failed to appreciate the binary nature of the outcome of this case, and overestimated the odds that CPRI would prevail on the merits of the case. Upon reflection of the outcome, it is now clear to us that companies that present binary outcomes should not have a place in our concentrated stock portfolio.

When the acquisition was announced, our holding period was less than a year and if we sold on the announcement date, we would have been subject to short-term gains. Additionally, the spread between the deal price was a healthy 7-9%, effectively becoming an attractive cash proxy. At the time our portfolio had elevated cash levels and were not concerned about the deal being terminated, so we held the position.

What we didn’t consider is that once the deal was announced, Capri’s management shifted their attention away from the business and towards closing the deal. Employees concerned with losing their jobs because of the integration started looking for new jobs. Capri’s business rapidly deteriorated, which was compounded by a slowdown in the luxury market. Management was completely silent on the business during the acquisition process and when they finally gave an update following the termination of the merger, we were stunned by the damage to the operations and brands.

We lost confidence in our ability to determine an appropriate valuation range for Capri, as our range of potential outcomes widened significantly. Additionally, the decline in their operations has imperiled the quality of their balance sheet.

We made the decision to exit our position Capri. More importantly, we learned a valuable lesson that we will not repeat in the future. Any of our companies that become subject of a takeover will be replaced upon the announcement of the deal.

Elsewhere in the portfolio, results were relatively balanced between gains and losses, as recent market fluctuations have presented both challenges and opportunities. Within our top five contributors, our technology holdings were standouts, with Expedia (EXPE), Alphabet (GOOG), and Cisco (CSCO) registering notable advances. In fact, shares of GOOG came under pressure early in the quarter and we added to our position before the stock rebounded to new all-time highs. Ulta Beauty also saw a resurgence, suggesting that the competitive pressures stemming from Sephora’s expansion within Kohl’s stores have begun to recede. We continue to see very attractive upside across each of this quarter’s winners.

Our detractors were led by homebuilders which took a breather after a strong run-up in share prices over the last two years. Among our most recent investments is Micron Technology (MU). It’s not uncommon for our newest portfolio additions to initially appear on the list of top detractors. Our investment philosophy centers on identifying companies that, while currently out of favor with the broader market, possess strong underlying fundamentals and significant long-term potential. As we are not market timers, negative price momentum can often continue for several quarters after our initial purchase.

In addition to our investment in Micron we also established a new position in Kinsale Capital (KNSL). We will discuss our investment cases for both Micron and Kinsale below. The remainder of our trading activity this quarter consisted of trimming Expedia, Generac (GNRC), and CBOE Markets (CBOE) on success. CBOE is at the top end of our estimated intrinsic valuation range, and we may exit completely if the share price continues to advance.

Micron is a US-based semiconductor company that develops and manufactures memory and storage solutions, powering everything from consumer gadgets and high-performance servers to cutting-edge AI applications and the next generation of automobiles. In a market increasingly defined by its oligopolistic structure, Micron competes against Samsung and SK Hynix that are each capable of producing the industry’s most advanced DRAM, NAND, and HBM memory chips.

The escalating complexity of chip design and the astronomical costs associated with constructing new fabrication facilities have limited new entrants and discouraged aggressive capacity expansion. This, in turn, has mitigated the historical cyclicality of the memory sector, lessening the financial impact of downturns like the recent trough experienced in 2023. The result is a more resilient industry poised for sustained growth and higher average profitability. We saw a similar rationalization in the Semiconductor Equipment industry.

Currently valued at approximately $150 billion, the memory market is projected to expand at a double-digit pace through the end of the decade. Artificial intelligence, particularly the rise of sophisticated AI agents, will be a key catalyst. These advanced applications rely on High Bandwidth Memory (HBM), a specialized form of DRAM that functions more like a comprehensive memory system than a traditional chip. Micron and SK Hynix have emerged as technological leaders in this space, positioning themselves to capitalize on the exploding demand for HBM. Market projections suggest HBM demand could surge to over $100 billion by 2028, a dramatic leap from just $16 billion in 2024.

We anticipate Micron will secure a substantial share of the burgeoning HBM market. Coupled with the anticipated cyclical rebound in the PC and smartphone sectors, this positions the company for significant earnings growth, potentially reaching $10-$14 per share over the next few years. Bolstering this outlook is Micron’s robust balance sheet, carrying a manageable net debt of $5.7 billion, translating to a net debt/EBITDA ratio of just 0.3x.

Considering the company’s financial strength, balanced against the inherent cyclicality of demand for PC and smartphone components, we believe an 11-13x earnings multiple is appropriate. This yields an intrinsic valuation range of $110-$180. We initiated our position at $99 per share.

Kinsale Capital is a pure-play participant in the burgeoning Excess and Surplus (E&S) insurance market. Kinsale’s technologically superior operating system positions it to capture significant market share and deliver industry-leading financial performance. We believe this translates into a durable competitive advantage, fueling above-market growth and superior profitability for years to come. In short, Kinsale appears to be that rare breed of business compounder that value investors like us seldom have the opportunity to own.

The E&S market, driven by increasingly complex insurance needs and the rise of newly identified risks, is experiencing a surge in demand. Customers are seeking supplemental coverage for lower-frequency, higher-severity claims – precisely the domain of E&S insurance. This specialized segment, distinct from the traditional home and auto coverage of the standard property and casualty market, has exploded in size. Over the past five years, it has expanded at a double-digit pace, from $30 billion in 2018 to over $100 billion today, representing roughly 10% of the total P&C market. With the frequency and cost of catastrophic events on the rise, we anticipate continued low double-digit growth in the E&S sector. Kinsale, currently holding a 1.5% share of this expanding market, has ample room to grow.

Kinsale’s secret weapon? An in-house technology stack optimized for E&S underwriting. This system allows them to provide wholesale insurance brokers with bespoke E&S policies and quotes in under 24 hours. By standardizing the Request for Proposal (RFP) inputs from wholesalers, Kinsale’s software facilitates rapid in-house underwriting and risk analysis.

This streamlined approach stands in stark contrast to the competition. Legacy players often rely on a patchwork of disparate systems, sometimes outsourcing underwriting, and typically engage with both direct buyers and wholesalers. This cumbersome process translates to higher costs and significantly longer turnaround times for quotes, often stretching to a week or more. Brokers, seeking speed and fair pricing, naturally gravitate towards Kinsale.

We believe Kinsale’s underwriting technology is difficult for larger competitors to replicate. Entrenched with legacy systems acquired over time, these established players face a daunting task in rebuilding from the ground up. Few, if any, are willing to undertake such a radical overhaul of their mission critical software systems. Consequently, we expect Kinsale’s underwriting advantages, and subsequent market share gains, to persist.

Crucially, Kinsale’s focus on speed and efficiency doesn’t come at the expense of underwriting discipline. Their loss ratio has averaged approximately 58%, outperforming the industry average. Even more impressive is their expense ratio, averaging a mere 22%, significantly lower than the industry norm of 26-36%. This translates to a return on equity (ROE) nearly double the industry average, a performance we believe is sustainable for the medium term.

Considering both the underlying growth of the E&S market and Kinsale’s ability to capture share, we project premium growth of 18-25% (though recent performance has been closer to 40%). Assuming a combined ratio of 75-80%, we forecast normal EPS of $18-$23 over the next few years. Given their sustainable competitive advantage, rapid growth, robust balance sheet, and conservative investment policies, we deem a multiple of 25-30 appropriate, yielding an estimated intrinsic value of $450-$700 per share. We established an initial small position at $460, a price point that pushed the market capitalization above our preferred $10 billion threshold for initial investments. Should the share price retreat below $400, we intend to increase our position to a more typical allocation.

Lastly, we wanted to revisit the Investment Philosophy of the Concentrated Value portfolio. We utilize a value investment strategy that seeks out companies for investment which the Portfolio Manager deems to be high quality companies. Quality is defined by possessing business operations with durable competitive advantages, allowing for high returns and growing cash flows streams. We want these high-quality companies to also have solid balance sheets, preferably with a net cash position. We also prefer that their management teams make decisions with an emphasis on maximizing shareholder returns.

Once we find these high-quality companies, we generally only invest in their stock if they trade at a steep discount to our estimate of their intrinsic value. This is necessary to provide our investors with the opportunity to generate an above-market return and protect capital. This discipline creates a wide margin of safety if an undesirable scenario plays out in the future. Pelican Bay Capital Management believes that identifying a significant difference between the daily market value of a security and the intrinsic value of that security is what defines an investment opportunity.