To view this letter in PDF Format lease click here:2024-Q1 PBCM Investor Letter.pdf

Welcome to our new investors and thank you to our existing clients and partners for your continued support. We are pleased to present our results for the fourth quarter of 2023 in the following pages.

After reading this letter, please do not hesitate to contact us if you have any questions, want to discuss any topics in greater detail, or would like to learn more about our Concentrated Value portfolio. We can be easily reached via e-mail at info@pelicanbaycap.com. We welcome your feedback and look forward to your correspondence. Additionally, we encourage you to share this letter with your friends and colleagues.

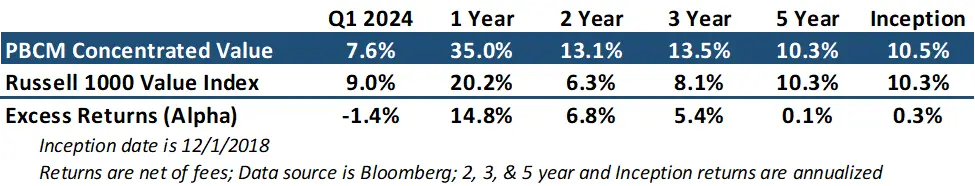

Stock markets surged in the first quarter, fueled by excitement for artificial intelligence (AI) companies and anticipation of looser monetary policy from the Federal Reserve. The S&P 500 returned an impressive 10.6%, and the Russell 1000 Value Index climbed 9.0%, exceeding even the most optimistic forecasts. These gains are particularly noteworthy considering headwinds from rising interest rates, higher commodity prices, and a strengthening dollar.

The Concentrated Value strategy delivered a 7.6% return for the quarter, trailing the Russell 1000 Value benchmark by 1.4%. While we acknowledge some disappointment in trailing the benchmark, it’s important to remember that all investment strategies experience periods of underperformance. Candidly, the portfolio was due to give up some ground as the portfolio has wrapped up several years of positive alpha as it had outperformed the benchmark last year by 17.2% and has beaten it in 7 of the last 8 quarters.

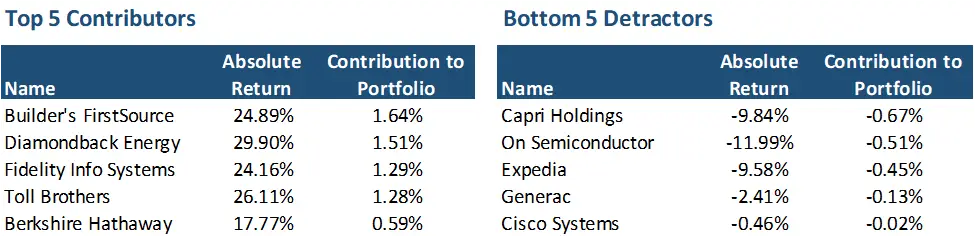

Our underperformance this quarter was mostly the result of a difficult earnings season where a handful of disappointing results from On Semiconductor (ON), Expedia (EXPE), and Alphabet (GOOG) outweighed others’ mostly positive earnings reports.

Additionally, investor concerns regarding potential regulatory hurdles for Tapestry’s (TPR) acquisition of Capri (CPRI) caused CPRI’s share price to decline from $50 at the beginning of the year to $45 at quarter’s end, well below the proposed acquisition price of $57 per share.

We believe the acquisition is unlikely to be blocked. The combination of Capri-Tapestry does not come close to exceeding any of the standard legal tests applied in antitrust cases. It is our opinion that for the FTC to block the deal, regulators would need to employ an untested or novel antitrust theory, which courts are typically hesitant to consider. We expect regulatory clarity by May.

Our homebuilding-related holdings continued to deliver strong returns. Builder’s FirstSource (BLDR), the nation’s leading wholesale distributor of building supplies, was our top performer for both the last quarter and the past year. Their focus on scale and automation has driven margin improvement, generating significant free cash flow. This cash is being strategically used to reduce outstanding shares, with a 16% buyback completed last year. By quarter’s end, BLDR became our largest portfolio position.

Toll Brothers (TOL), a luxury homebuilder, also saw substantial gains due to continued strong demand and elevated pricing. Their wealthy clientele is less reliant on mortgages and benefits from rising asset values, making them less sensitive to interest rate hikes.

Homebuilders, in general, have become less financially leveraged and cyclical, mitigating past concerns about rising interest rates impacting the existing home market. We believe investors are recognizing this shift and starting to value homebuilders based on price-to-earnings (P/E) ratios, a more appropriate metric compared to the historical use of price-to-book (P/B).

For example, Toll Brothers’ P/B ratio of 1.7x, historically considered expensive, translates to a P/E of only 8.0x. This significant discount to the S&P 500’s 21x P/E suggests potential for a re-rating, with justifiable P/E ratios of 13-16x offering substantial upside for shareholders. We believe the recent relative strength of homebuilders has lots of runway left.

The portfolio received a significant boost from our energy holdings in Q1. This sector was the S&P 500’s leader, surpassing even Technology and Communications. Diamondback Energy (FANG) surged 29.9% as oil prices rebounded on stronger-than-expected demand forecasts. Notably, the company also announced a major acquisition that will substantially increase their Permian Basin production.

We remain very optimistic about oil prices. Demand is projected to exceed supply throughout the summer months. Global oil inventories are near historic lows, raising the risk of further drawdowns that could push prices even higher. This potential price increase would benefit our investments in Diamondback and EOG Resources (EOG).

Turning to portfolio activity for the first quarter, we exited our position in Republic Service (RSG) on success. Republic has been a staple in our portfolio as it is an outstanding company with a shareholder value-maximizing management team. It is the kind of company that you would feel comfortable owning forever. However, the valuation had become too rich for us to maintain our position. The share price had appreciated to a level that was 20% above our highest estimate of intrinsic value.

We also trimmed our stakes in Berkshire Hathaway (BRK/B) and CBOE Global Markets (CBOE) into strength as both companies approached the top end of their respective valuation ranges. We redeployed this capital back into EOG, EXPE, Fidelity Information Systems (FIS), and Verizon (VZ) as these companies saw pullbacks in their share prices towards the low-end of valuation ranges. We also initiated a new position in Barrick Gold.

Barrick Gold (GOLD) stands as the world’s largest gold miner, boasting a diversified global portfolio of 10 gold mines and 3 copper mines. These mines hold a significant 77 million ounces of proven and probable reserves. The company benefits from a geographically balanced footprint, with 50% of gold production coming from North America, 37% from Africa, and 13% from South America.

Notably, Barrick is led by Mark Bristow, a widely respected figure considered the best manager in the mining industry. Under his leadership since 2019, Barrick has impressively replaced over 140% of its gold reserves with mines that maintain the same high ore grade as their initial holdings – a critical achievement accomplished organically, without resorting to dilutive acquisitions.

Barrick currently produces around 4.1 million ounces of gold annually and has a development pipeline to grow their production to 4.7 million ounces by 2027. These investments include projects with very high ore grades that will lower total cash cost per ounce from $900-$1,000 today to approximately $800 per ounce in 2027. Similarly, all-in sustainable costs will fall from $1,300 per ounce to $1,050 per ounce over that period. The company is also a prolific copper miner and is on pace to double their copper production by 2028.

Barrick has a strong financial position with $4.7 billion in debt with very long maturities. 98% of their debt is termed between 2033 and 2043 with an average weight of 15 years and 6% coupon. The company also has a $4 billion un-tapped revolver that matures in 2028, as well as $4.1 billion of cash on hand. The net debt is just $580 million which represents a 0.1x net debt-to-EBITDA ratio. Barrick currently has a 2.5% dividend yield.

With Gold prices of 1,800-2,100 per ounce we believe Barrick gold can generate operating cash flow of $4.0 to $5.3 billion in 2025. Capital expenditures (CAPEX) should run around $3.2 billion for the next 2 years before declining as new projects are completed. We believe normal earnings power is $1.00-$1.30 per share, with the potential for a substantial increase should gold prices continue to rally. At the time of this writing gold prices were pushing through all-time highs and are above our estimated range of our normal earnings model. If gold prices moved to $2,400 as some analysts have forecasted, earnings per share could exceed $2.00 per share. Our estimated range of intrinsic value of Barrick is $18-$27 per share. We initiated our position at $15.80 per share.

We closed the quarter with 19 holdings, maintaining our disciplined approach to making new investments. The current market rally has presented challenges in finding opportunities that meet our strict criteria. We prioritize patience over impulsive additions and are confident an attractive investment will emerge. We look forward to sharing our next selection in the upcoming quarter’s letter.

Lastly, we wanted to revisit the Investment Philosophy of the Concentrated Value portfolio. We utilize a value investment strategy that seeks out companies for investment which the Portfolio Manager deems to be high quality companies. Quality is defined by possessing business operations with durable competitive advantages, allowing for high returns and growing cash flows streams. We want these high-quality companies to also have solid balance sheets, preferably with a net cash position. We also prefer that their management teams make decisions with an emphasis on maximizing shareholder returns.

Once we find these high-quality companies, we generally only invest in their stock if they trade at a steep discount to our estimate of their intrinsic value. This is necessary to provide our investors with the opportunity to generate an above market return and protect capital. This discipline creates a wide margin of safety if an undesirable scenario plays out in the future. Pelican Bay Capital Management believes that identifying a significant difference between the daily market value of a security and the intrinsic value of that security is what defines an investment opportunity.