To view this letter in PDF Format lease click here: 2022-Q2 PBCM Investor Letter.pdf

Welcome to our new investors and thank you to our existing clients and partners for their continued support. We are pleased to present our results for the second quarter of 2022 in the following pages.

After reading this letter, please do not hesitate to contact us if you have any questions, want to discuss any topics in greater detail, or would like to learn how to invest in the Concentrated Value Fund. We can be easily reached by phone at 239-738-0384 or via e-mail at info@pelicanbaycap.com. We welcome your feedback and look forward to your correspondence. Additionally, we encourage you to share this letter with as many friends and colleagues as you like.

At the core of our investment philosophy, we seek to own high-quality companies with solid balance sheets and defensible business models that are generating significant levels of free cash flow. We only invest our capital in these companies when they are trading at undemanding valuation multiples that represent a price that we believe is well below our estimate of their intrinsic value. We seek to maintain our investments in these firms unless they become clearly over-valued, or a much more attractive opportunity presents itself.

Over a full market cycle and across a variety of economic conditions, we believe that our investment process should generally produce attractive returns on capital. However, during periods of market stress, it is not unexpected that our relative performance versus our benchmarks could widen significantly as a greater number of market participants train their attention on business profitability, balance sheet strength, and valuation.

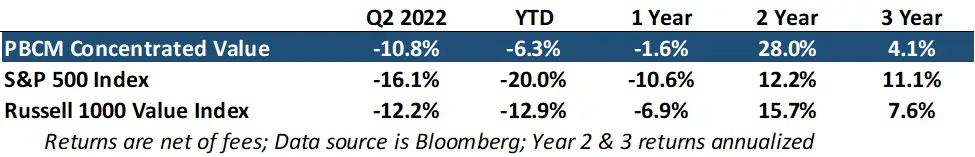

Given the recent weakness in asset prices, we believe we are in one of these periods now and our portfolio has weathered the storm well. As you can see in the table above, as financial conditions deteriorated the Concentrated Value Fund outperformed the S&P 500 by 1,370 basis points year-to-date and 900 basis points over the last twelve months.

Readers of our last few quarterly letters will know that we have been concerned that markets could become more volatile in 2022. While the immediate path of markets is always unknowable, we thought the probability that markets could correct to the downside had become elevated. This view was predicated on two observations.

First, inflation had continued its march from 5% this time last year, up to 7% at the beginning of 2022. With increasing housing costs and commodity prices, as well as very tight labor markets, we thought inflation could remain elevated several quarters into the future. This should result in higher interest rates as bond investors demand higher yields as compensation. As interest rates increase, valuation multiples should contract to reflect the higher required return for all assets. In late December the price-to-earnings (P/E) multiple for the S&P 500 was 21x. If interest rates increased by 2%, we thought the P/E multiple could contract to 14-17x earnings estimates. (Interestingly, this is precisely what has happened as of this writing).

Second, in 2021 we observed mounting evidence of extreme euphoria in various corners of the financial markets. Some examples include the meme stock phenomenon, the record increase in SPAC or “blank check” stock issuance, a greater percentage of IPOs that were profitless companies, and the rise of speculative crypto currencies. Interestingly, each of these frothier assets began to see large price declines in early November, with losses between 30-60% by the end of December. A common characteristic of asset bubbles and market downturns is that the more speculative investments tend to collapse first.

Now that we have progressed through the first half of 2022, not only has the market proved volatile with some downside risk, but we have entered a painful bear market in stocks. In fact, most asset classes have begun the year with negative returns for the record books. The S&P 500 was down 20.6% in the first half. According to Barron’s magazine, this drop in the S&P was the worst first six months of the year since 1970, and the second worst on record. Meanwhile the growth-oriented Nasdaq composite tumbled 30% and small-cap Russell 2000 index fell 24%. Both are new records for the weakest first half of the year returns in history.

Even bonds as measured by the Barclays US aggregate broad index fell 11% in the first half of 2022. This is the first time in four decades that bonds didn’t provide a positive counterbalance to stocks in a falling market. The venerable 60/40 stock/bond portfolio model fell 11.5% in the second quarter and 16.1% year-to-date. Outside of commodities and high-quality value stocks, there were few places for investors to hide.

The challenge with bear markets like the one we have been experiencing this year, isthat it is common to experience periods of capitulation selling, where most stocks go down in unison. We saw this occur in the last half of June.

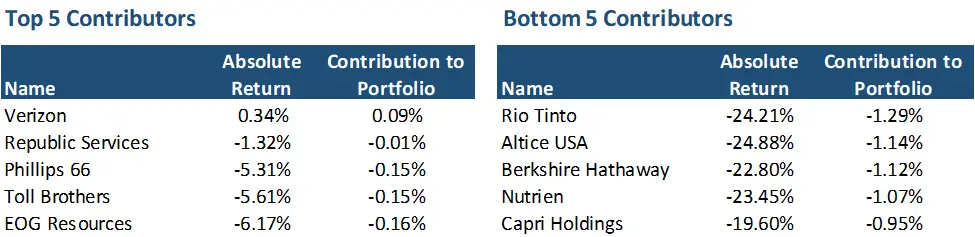

Up until mid-June the Concentrated Value Fund was flat for the quarter with an even mix of stocks up and down in the quarter-to-date period. In the ensuing two weeks, the portfolio dropped 10% as all assets seemingly fell in unison. As you can see in the table below, the only stock in the portfolio that finished the quarter in positive territory was Verizon, which managed to eke out a 0.3% return. Even the steadfast and well managed Berkshire Hathaway landed on our list of top detractors in the portfolio this quarter.

The breadth of the drawdown felt like a panicked liquidation to us as there seemed to be indiscriminate selling and even the winners for the year-to-date period saw some of the largest drawdowns. Of course, sharp across-the-board drawdowns are a common feature of bear markets.

These periods of panic selling where the proverbial “babies get thrown out with the bathwater” also lead to great opportunities for patient investors to purchase shares in amazing companies at discounted prices. At the end of the quarter our cash position represented nearly 10% of the portfolio and we have our shopping list ready. Investors should not be surprised if we announce two or three new investments by next quarter’s letter.

While we have preserved our cash for coming opportunities and didn’t initiate any new positions in the second quarter, we were not entirely inactive during the period. We had been trimming our energy stocks and fertilizer companies early in the quarter at what has since proven to be near-term highs. We redeployed these gains into Verizon, Toll Brothers, and Altria after each of these stocks came under pressure during the quarter. In the first week of July, we also added back to our positions in energy stocks as they had fallen 30% from their recent highs.

We continue to believe it is more than likely that commodity prices remain elevated in the coming years, particularly for oil and natural gas. We have talked at length on the rationale for our positive outlook on commodities in our last several letters which can be found on our website at www.pelicanbaycap.com.

While we won’t repeat the entire case for commodities in this letter, we can neatly sum up our position in two sentences. Simply, our analysis has led us to believe that as the economy recovers demand for oil would exceed supply of oil and there would be no spare capacity remaining to close this shortage. As this excess demand drains global oil inventories, more investors would come to realize the reality that supply growth wouldn’t be forthcoming and prices would escalate materially.

This is precisely what has played out this year. We think the war in Ukraine made the existing imbalance between supply and demand obvious to more investors. Interestingly, the recent commodity sell-off in June represents a compelling opportunity to increase exposure to energy-oriented securities. Some of the top oil producers have seen their shares fall 30-40% in the past few weeks to valuations that reflect oil prices in the $70 range. Should oil prices stay above $90 per barrel (it is $104 at time of publication) these companies will generate annual free cash flow margins of 10% or higher.

The explanation we hear most frequently from the financial press explaining the sell-off is that it was sparked by fears of demand destruction caused by an upcoming recession. However, oil demand is largely inelastic and has historically fallen 0-3% in prior recessions. We believe that oil demand will continue to outweigh supplies and inventories will keep falling, especially through the peak summer months. Additionally, now that OPEC has raised their production levels back to full capacity, we don’t believe there is any spare capacity remaining. We are unaware of any other time since the dawn of the oil age that the world has not had any spare capacity.

Besides a small gain at Verizon, Toll Brothers and Republic Services also held up well in the drawdown with only minor declines in the quarter. On their earnings call in late May, Toll Brothers reported strong demand and pricing for their luxury homes despite rising interest rates. Subsequently other major builders have reported similar strong results and positive outlooks. We believe that the home builders are poised to benefit for several years as the US continues to be plagued by a shortage of homes from more than a decade of underbuilding. The effect is especially pronounced in the sunbelt where the deficit is being compounded by a surge in net migration from the Northeast and Midwest.

Republic Services is one of the compounders in our portfolio. The company benefits from CPI linked contracts in their residential garbage pickup business which is recession resistant. Additionally, the company has strong pricing power at many of their landfills, as it is extraordinarily difficult to win approval of a new competing landfill. RSG has grown their EPS at 12% annually over the last 8 years with EBITDA margins of approximately 30%.

Lastly, we wanted to revisit the Investment Philosophy of the Concentrated Value Portfolio. We utilize a value investment strategy that seeks out companies for investment which the Portfolio Manager deems to be high quality companies. Quality is defined by possessing business operations with durable competitive advantages, allowing for high returns and growing cash flows streams. We want these high-quality companies to also have solid balance sheets, preferably with a net cash position. We also prefer that their management teams make decisions with an emphasis on maximizing shareholder returns.

Once we find these high-quality companies, we generally only invest in their stock if they trade at a steep discount to our estimate of their intrinsic value. This is necessary to provide our investors the opportunity to generate an above market return and protect capital. This discipline creates a wide margin of safety if an undesirable scenario plays out in the future. Pelican Bay Capital Management believes that identifying a significant difference between the daily market value of a security and the intrinsic value of that security is what defines an investment opportunity.

On the operational front, Pelican Bay Capital Management is pleased to announce that Trevor Klym has joined our team as an Equity Research Intern for the Summer. Mr. Klym will report directly to Portfolio Manager Tyler Hardt. He will be tasked with conducting research and analysis on publicly traded companies for potential future investment, along with building financial models.

Mr. Klym is an incoming junior at The Ohio State University majoring in Business Administration with a specialization in Finance and minoring in Economics. Furthermore, Mr. Klym is a member of the Ski and Board Club and the Ohio State Financial Planning Association.