To view this letter in PDF Format please click here: 2022-Q1 PBCM Investor Letter.pdf

Dear Investors,

Welcome to our new investors and thank you to our existing investors and partners for their continued support.

The first quarter of 2022 proved challenging as interest rates rose sharply and valuations for many assets declined. Growth stocks and small-cap stocks were hardest hit with both the Nasdaq Composite index and Russell 2000 small-cap index reaching bear market territory from their November all-time highs. For the quarter these indices were down -8.9% and -7.5% respectively. Even the venerable 60/40 portfolio fell -5.1% as the S&P 500 was down -4.6% and the Barclays Aggregate Bond index fell -5.9% (the worst quarter for the bond market since 1984). There were few places to hide apart from commodities and high-quality value stocks.

Given the broad selloff in assets, we are especially pleased to share our performance results for the first quarter as our portfolios continued to outperform their respective benchmarks. The Concentrated Value portfolio gained 5.1%, widely outpacing the S&P 500 and Russell 1000 Value indices. The Phoenix Fund, which has historically struggled in risk-off environments, managed a positive return of 2.6% aided by hedges and a buyout of our largest position. We will provide a detailed analysis of each portfolio’s results in the pages that follow.

As always, if after finishing this letter you have any questions or would like to discuss any topics in greater detail, please do not hesitate to call us at 239-738-0384 or send an e-mail to info@pelicanbaycap.com. We welcome your feedback and look forward to your correspondence. Additionally, we encourage you to share this letter with as many friends and colleagues as you like.

Concentrated Value

For the last decade, commodity prices have been in a secular bear market that had resulted in years of under-investment by the industry as the cost to develop new production capacity was well above the prevailing market price. This led to stagnating supply levels for most commodities as well as higher marginal costs as older/low-cost capacity was exhausted.

None the less, the global economy and demand for commodities continued unabated as billions of people joined the middle-class. Major commodities such as oil, copper, aluminum, uranium, and potash that had been oversupplied for years were beginning to come into balance with no spare capacity to support further increases in demand. We believed that commodity prices were poised to increase substantially as markets became under-supplied and inventory levels fell below normal.

However, this was a contrarian view. A decade long bear market made it easy for investors to ignore commodities. Markets seemed to be unconcerned that the balance between supply and demand had become very tight. Unfortunately, it took the Russian invasion of Ukraine to make it painfully obvious to investors and policy makers that many commodity markets were undersupplied with little or no spare capacity. As buyers rushed to secure supplies, prices for energy, metals, fertilizers, wheat, and corn skyrocketed.

Not surprisingly, the best performing asset class in the quarter by a wide margin was commodities. The Bloomberg Commodity index rose 25% in the first quarter, which is in stark contrast to the negative returns of stocks and bonds. Given our bullishness on commodity prices, we had accumulated a healthy exposure to energy and basic materials companies since last summer. Combined, these two sectors contributed to 7.25% of our return in Q1 and represented all five of our top contributors as can be seen in the table below.

Nutrien (NTR) was our largest winner this quarter. They benefited from rising prices for nitrogen and potash fertilizers. NTR is the largest potash producer in the world with its low-cost mines in Canada representing roughly 22% of global capacity. Prices that had already increased from $200 per ton to $600 per ton in the last two years, jumped 22% in the first quarter to $830 ton. For reference, their cash cost to produce a ton of potash is just $94.

The second and third largest potash suppliers are Belaruskali and Uralkali with mines in Belarus and Russia respectively. Combined these companies represent 27% of global capacity and have seen shipments halted as both face sanctions and scrutiny related to the war in Ukraine. The loss of this production will result in significant shortages for the upcoming planting season. Unfortunately, there are no new sources of potash supply coming to the market for six to eight years at the earliest, as it takes this long to develop a new potash mine. Should potash from Belarus and Russia remain off the markets for an extended period, potash prices could move much higher.

Oil companies EOG Resources (EOG) and Diamondback Energy (FANG) were our second and third best contributors as oil prices similarly spiked on the loss of Russian oil supplies due to the war in Ukraine. We trimmed our positions in NTR, EOG, and FANG during the quarter as these positions grew too large in the portfolio. We remain bullish as we believe these names continue to be undervalued should commodity prices remain near current price levels.

Toll Brothers (TOL) was our largest detractor from performance this quarter. Shares fell 35%, effectively reversing its price gain from last fall. Home builders sold off sharply as interest rates rose. Historically, home builders see demand drop as mortgage rates rise. However, we continue to see strong demand for new housing despite higher rates as millennials move from cities to suburbs and the work-from-home movement has enabled millions of people to move to sunbelt states where there is a material shortage of housing.

We believe TOL can generate earnings of $7-$11 for the next several years as they deliver on their existing backlog and maintain their recent pace of new contract signings. Our estimate may be too low as the company funnels excess cash into share repurchases that could shrink the share count by 10-20% annually. The current price of $45 per share for TOL represents a 4-6x earnings multiple, which is absurdly low. We have been adding to our position in recent days.

Turning to trading activity in the quarter, we made the decision to exit our position in CVS on success. The stock price had run up to the high end of our estimate of fair value at $105 per share. The increase in share price was driven by a temporary boost in pharmacy sales related to increased vaccine administration and covid testing related to the surge in the Delta and Omicron variants in the fourth quarter. We believe covid related services increased profitability for the Pharmacy unit by 30-40%. CVS’s Aetna Insurance unit also benefiting from lower healthcare reimbursement expenses as elective surgeries and preventative medicine were curtailed during the pandemic. As the pandemic transitions to an endemic, we believe these windfall profits could reverse.

Additionally, we see increasing headwinds to profit margins in the Pharmacy business due to escalating salaries required to retain disgruntled pharmacists. Unlike traditional retail, these costs can’t be recaptured by CVS unilaterally raising drug prices. Similarly, the general merchandise portion of the store is facing inflation headwinds as vendors raise prices and transportation costs increase. As merchandise pricing at Pharmacies was already higher than grocery stores and supercenters, they have less ability to raise prices if they wish to remain competitive.

We initiated a new position in Artisan Partners (APAM) late in March. APAM is a leading investment management firm that has established a reputation for developing investment teams that can deliver alpha against their benchmarks. APAM has also built a superior distribution platform with strong relationships across the institutional investment landscape including pension funds, endowments, sovereign wealth funds, and 401(k) plans. These institutional clients account for roughly two-thirds of their assets under management. The company has been able to consistently grow assets under management through inflows to new strategies and has just begun scratching the surface with higher fee hedge fund and alternative strategies.

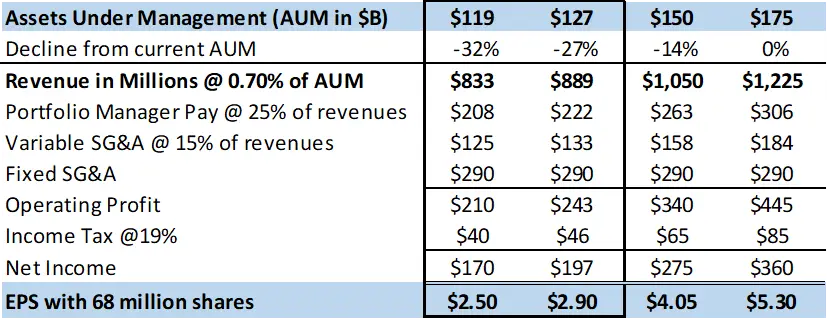

APAM has approximately $175 billion in assets under management. They generate approximately 0.70% in management fees on these assets. The business model produces very high operating margins in the range of 40-46%. APAM can maintain high margins as more than half of the company’s expenses are variable in nature as they are directly tied to revenues. For example, the investment management teams are compensated with approximately 25% of revenues. Variable costs within the SG&A line account represent an additional 15% of revenues. We believe that $290-$300 million of the current cost structure is represented by fixed costs.

The company’s elevated margins produce substantial free cash flow that is entirely returned to shareholders via a variable dividend. In the last 12 months APAM has paid out $3.82 per share in dividends, representing a 11% dividend yield.

The stock recently fell to $35 per share which appears to be pricing in a significant drop in assets under management. We believe APAM should trade at 12-14x earnings given its record of attracting new client inflows, clean balance sheet, and generous capital allocation policy that returns every dollar of free cash flow to investors via dividends. Using a 12-14x P/E ratio, the current share price is implying that normal earnings power is in a range of $2.50-$2.90 per share. For perspective APAM earned $5 per share last year analysts are forecasting $4.36 in 2022. Our analysis suggests that assets under management would need to fall by approximately 27-32% for APAM to generate the currently implied normal earnings power (see table below). A drop of this magnitude is not impossible, but unlikely in our opinion.

We believe that APAM should be able to generate normal earnings power over the next few years of $4-$6 per share which would result in an intrinsic value of $48-$84 per share. Until the recent swoon in markets, APAM had been trading above $50. We acquired our shares for $35 apiece representing a significant discount to our estimate of intrinsic value.

Lastly, we wanted to revisit the Investment Philosophy of the Concentrated Value Portfolio. We utilize a value investment strategy that seeks out companies for investment which the Portfolio Manager deems to be high quality companies. Quality is defined by possessing business operations with durable competitive advantages, allowing for high returns and growing cash flows streams. We want these high-quality companies to also have solid balance sheets, preferably with a net cash position. We also prefer that their management teams make decisions with an emphasis on maximizing shareholder returns.

Once we find these high-quality companies, we generally only invest in their stock if they trade at a steep discount to our estimate of their intrinsic value. This is necessary to provide our investors the opportunity to generate an above market return and protect capital. This discipline creates a wide margin of safety if an undesirable scenario plays out in the future. Pelican Bay Capital Management believes that identifying a significant difference between the daily market value of a security and the intrinsic value of that security is what defines an investment opportunity.

Phoenix Fund

Please note: The Phoenix Portfolio is only available to “Qualified Clients” pursuant to section 205(e) of the Investment Advisors Act of 1940 and section 418 of the Dodd-Frank Act.

The Phoenix Fund had excellent results for the first quarter generating a 2.6% return net-of-fees. The portfolio was able to achieve these results despite a decidedly “risk-off” environment that resulted in the portfolio’s benchmark, the Russell 2000 index, falling -7.5% in the quarter.

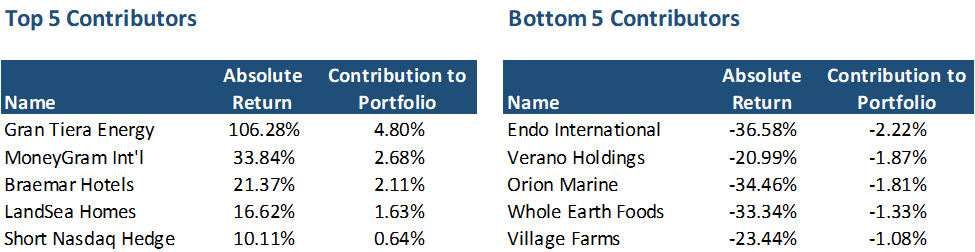

The portfolio’s returns in the quarter were aided by strong gains from Gran Tierra Energy (GTE), an oil company with operations in Columbia. It’s shares advanced 106% in the quarter in response to the increase in oil prices. At the recent price of $1.60 per share, GTE remains significantly undervalued relative to its asset value. At current Brent oil prices, the net asset value of proved reserves using the SEC PV-10 calculation methodology would yield a price of more than $4 per share. For comparison, when Brent oil prices reached $90 in 2018, GTE shares climbed as high as $4 per share.

The portfolio also benefited from another buyout of one of our investments for the second quarter in a row. MoneyGram International (MGI) announced that it would be acquired by a private equity firm for $11.00 per share. This is a significant gain to our $5.70 purchase prices 5 months ago in November. The offer is a fair price and is in the range of our intrinsic value estimate of $10-$15 per share. For more details on our investment case on MGI, please see our Q4 2021 letter.

Our top 5 and bottom 5 contributors to returns can be found in the table below.

Our largest detractor to performance this quarter was Endo International (ENDP). Investors were disappointed by a negative patent ruling on one of their generic drugs, as well as another potential negative summary judgement in a Tennessee court related to an opioid lawsuit. We continue to believe the company has $1 in earnings power and will ultimately reach an acceptable settlement across their opioid litigation. Our estimated opioid liability is $1.5-$3.0 billion paid over ten years. To date, settlements reached between Endo and various jurisdictions suggest the ultimate liability is tracking to the lower end of that range.

The stock has been very volatile the last several quarters and we have regularly added and trimmed our position as the stock has swung between $2 and $7. As shares fell below $3 in February, we began to buy more and added 200 basis points to our position at $2.87 per share. As a reminder, we sold an equal amount of our earlier position in the fourth quarter for $4.51 per share.

Verano (VRNOF) gave back its gains from the prior quarter as investors’ enthusiasm for marijuana related stocks turned decidedly negative during the market selloff. Verano was also challenged with unexpected delays by the New Jersey Government to launch its consumer legalization initiative. The company has secured one of a handful of limited operating licenses in the state. They have invested heavily in anticipation of supporting the launch. This has resulted in short-term losses that will ultimately prove temporary once New Jersey gets going. We expect the state will be a significant contributor to future free cash flows at Verano. Additionally, there appears to be more momentum behind federal legalization that would open the door to traditional banking services and institutional investor ownership. We continue to believe shares are worth $20-30 without federal legalization, and significantly more should legislation ever pass.

Turning to activity in the first quarter, we also added to our positions in Loan Depot (LDI), Orion Marine Group (ORN), and Whole Earth Foods (FREE) as shares came under pressure during the market correction.

We exited our position in Village Farms (VFF) after sustained losses. The cannabis market in Canada continues to struggle with competitive pricing pressure and sustained market share from unregulated-illicit players. Given our increased exposure to the cannabis industry from our addition of Verano in Q4, we decided to sell VFF to limit our exposure to the nascent industry and take some losses to offset our capital gains. Verano has superior profitability and much better growth prospects.

During the first quarter, we initiated a new position in Quad Graphics (QUAD). Quad Graphics is a commercial printer and marketing solutions company that primarily serves customers in the consumer products and retail sectors. The company is a smaller version of RR Donnelley (RRD) and is undergoing a similar transition whereby they are managing an over-leveraged balance sheet and a structural decline in their legacy printing business. Quad Graphics’ restructuring playbook is identical to RRD as they are paying off debt and offsetting the structural decline in their legacy business by investing in faster growing sectors of the advertising industry. Quad has rapidly assembled an integrated marketing platform that includes offerings such as consumer packaging, data analytics, media planning, content creation, and digital marketing. This marketing solutions business has higher margins and organic growth in the range of 5-13%. Quad graphics is reaching the point where the growth in the marketing solutions business is now offsetting the low single digit declines in the legacy print business and revenues have stabilized.

Additionally, the company has made significant progress deleveraging their balance sheet. In the last two years the company has reduced their net debt by $410 million or 40% from the initial figure. For comparison, the current market cap is just $328 million. They achieved this significant reduction by suspending their dividend and directing all their free cash flow to debt paydown ($215 million) while also monetizing non-core assets. Their net debt to EBITDA ratio has fallen from an elevated 4.0x to a more manageable 2.5x at the end of 2021.

The company has a $212 million term note maturing in May of 2022 that carries a 7% coupon. We expect Quad Graphics to use cash to extinguish $112 million of the note, and another $100 million from their revolver to fund the remainder. This will result in a savings of $11 million in interest expense. This will leave $654 million of bank debt that matures in 2026. They will have ample liquidity afterward comprised of $295 million of unused capacity on their revolver and around $80 million in cash. With $80-$100 million in free cash flow and $240-$270 million in EBITDA, concerns about Quad Graphics’ balance sheet should be resolved.

Quad Graphics’ debt target ratio is 2.0-2.5x net debt to EBITDA. They will achieve this mark in 2022. We believe management may re-establish their dividend payment after meeting this objective. Its also thought the company has the capacity to generate $80-$100 million per year in free cash flow. They should be able to direct $25-$30 million to dividend payments while investing the remainder in bolt-on acquisitions to the marketing solutions segment. With 51.3 million shares outstanding this dividend would be $0.49-$0.58 per share. At the current share price of $5.86 this would represent a dividend yield of 8%-10%, which is significantly higher than similar moderately levered small-cap companies which are closer to 4-6%. This suggests that Quad’s shares could appreciate to $8-14 per share, well above the current price of $6.70 per share. Similarly, if Quad Graphics sold for reasonable metrics such as 5-6x EV/EBITDA, shares would trade for $12-$17. For comparison, RRD was recently bought out for 5.9x EV/EBITDA.

Finally, we wanted to revisit the investment philosophy of the Phoenix Fund. The portfolio takes advantage of structural biases against institutional ownership of financially levered companies with low-stock prices. We seek companies that have had their stock prices fall 70% or more in the last two years and are priced below $10 dollars per share. This outcome typically leads to forced selling from their institutional shareholders, creating the opportunity to make outstanding investments for less constrained investors.

Generally, these companies are under distress from poor performance caused by what we believe are temporary factors. These companies typically have elevated levels of debt, and any prolonged period of business stress could cause stockholders to endure substantial losses. The Phoenix Fund is a high-risk, high-return investment strategy. Please see the Risk of Loss Section of Part 2A of Form ADV referenced below.