To view this letter in PDF Format please click here: 2020-Q4 PBCM Investor Letter.pdf

Dear Investors,

2020 was a transformative year on so many fronts. On a societal level, we had an unprecedented crisis that challenged our daily routines and liberties that we were unknowingly taking for granted. Personally, many of us struggled with isolation, anxiety, and the loss of friends and loved ones who succumbed to the virus.

In March we overhauled several of our processes and we are pleased to report that each of our portfolios have responded positively to these adjustments, producing strong risk-adjusted returns. As it is so often in the aftermath of a crisis, we recognize with hindsight that we benefited from this chaotic experience and have emerged as better investors.

Once again, we are extremely excited to share our fourth quarter investing results as our portfolios delivered outstanding risk-adjusted returns. We continue to chip away at some of the abnormal losses we experienced in March. We have had thee consecutive quarter where we outpaced the broader market.

We are especially proud of the fact that we generated these returns without taking excess risk. In fact, up until November, the Concentrated Value portfolio carried elevated levels of cash; the Phoenix Fund had large hedges in place; and the Dynamic Income Allocation Portfolio was in a very conservative “Max Protect” positioning. The results for each portfolio for the fourth quarter and year-to-date are presented in the table below.

While the third quarter returns for each portfolio exceeded our expectations, we are disappointed with our full year results. The magnitude of the losses we experienced during the onset of the pandemic represented insurmountable headwinds for the year, particularly in the Concentrated Value and Phoenix portfolios. These portfolios had declines of 46% and 56% respectively in the first quarter of the year.

As we stated in our Q1 letter, these large losses were unacceptable, and we took several actions to ensure nothing of this magnitude happens again. Additionally, we knew we would need to produce superior results for several quarters to close this gap and deliver the returns we expect of ourselves and that investors should expect from us.

As our results from the last three quarters demonstrate, we have made substantial headway in this regard. During this period the Concentrated Value portfolio returned 57% and the Phoenix Fund jumped 94%. This compares to a 47% gain for the tech-heavy S&P 500. Importantly, we achieved these returns without taking excessive risk.

While it is early in 2021, the outperformance has carried over into the new year as our portfolios have come out of the gate strong. We believe our portfolios are well positioned for the current market environment and we are proactively managing risk levels should asset prices come under pressure.

Lastly, the fourth quarter marked a milestone for Pelican Bay as our firm celebrated its second anniversary in business. At the end of the quarter, Pelican Bay had $79.5 million of assets under advisement; up more than 10-fold from last year. We would like to welcome our many new investors to the Pelican Bay Family. We appreciate the opportunity you have bestowed upon us to realize your financial objectives with integrity and discipline.

The layout of this quarter’s letter will start with a general market commentary, followed by individual reviews and analysis of each of our portfolios including Concentrated Value, Dynamic Income Allocation, and the Phoenix Fund.

As always, if after finishing this letter you have any questions or would like to discuss any topics in greater detail, please don’t hesitate to call 239-738-0384 or send an e-mail to tyler@pelicanbaycap.com. We welcome your feedback and look forward to your correspondence. Additionally, we encourage you to share this letter with as many friends and colleagues as you like.

Market Commentary

Given all of the challenges businesses and the economy faced in 2020, the performance of many assets, particularly growth-oriented stocks, was astonishing. We don’t believe very many people could have honestly predicted that markets would sky-rocket in response to a global pandemic which caused economies in the developed world to completely shut down, gutting GDP by as much as a third in the second quarter.

None the less, as we enter 2021, asset valuations are at record levels. The S&P 500, Nasdaq, and Russell 2000 are at all-time highs. Everything in the fixed income world from 10-year treasury rates to junk-bond yields are not far off their record lows. More than $10 trillion in bonds is currently priced to yield less than zero. That is an extraordinary amount of capital that has locked in a guaranteed loss. The environment has been characterized by some as the “everything bubble.”

In the past few weeks several of our clients have asked us if we think that markets are in a bubble. Frankly, it is difficult to identify a bubble as you are living through it, and even more challenging to guess the moment it is poised to pop. But a number of respected investors are raising the reg flags.

One consideration to put the current market in perspective is to understand what future outcome is underpinning the current valuations. Growth stocks, which account for an ever-increasing portion of the stock market appear to be pricing in a scenario where (1) general economic growth is constrained and (2) interest rates stay near zero in perpetuity.

If that scenario unfolds then current asset values may turn out to be justified. But even if that is the case, then returns from here would still be lower moving forward. It is a fact of investing that as prices go higher and higher, future returns must go lower and lower.

In our best judgment, we do not believe a future of zero interest rates and no inflation into perpetuity is a reasonable potential outcome. Why is consensus betting on this outcome? It appears to us that investors are extrapolating falling rates and no inflation following the Global Financial Crisis. Fiscal deficits jumped and the Fed printed money through multiple quantitative easing initiates, yet there was no inflation.

But what is happening today is a whole different magnitude. The money supply is growing by 25% annualized and unlike after the Global Financial Crises, that money is finding its way into the economy. The $800 billion in fiscal stimulus looks like peanuts compared to the $4 trillion Congress has already approved with more on the way.

The evidence is already beginning to appear that a different path is more realistic. Commodity prices and inflation expectations are both creeping up. The US dollar is in a multi-year decline. Treasury rates have jumped from 0.60% just three months ago to 1.16% as we write this letter. That increase in yields is a massive move and the momentum is clearly up and to the right. We think it is entirely possible that inflation rears its teeth and interest rates continue on a path to higher levels.

Should this scenario continue to unfold, then markets will indeed prove to be in a bubble. Popular growth stocks will retreat, and long-duration fixed income investors will see principal declines that widely outpace their already thin yields.

A quick review of history shows that the last 10 years of market winners and laggards generally do not carry the day in the proceeding decade. Popular trends inevitably run their course and investor sentiment shifts in some form of a revision. In short, what worked the last 10 years likely won’t work the next decade and vice versa.

For example, in 1982 few people thought the Fed could tame inflation. Today it is the complete opposite, where no one believes the Fed can generate inflation.

As we look at the opportunity set today, we believe that commodities and emerging markets are poised to have their day in the sun after a decade of large relative underperformance versus US equities.

Moreover, we see a lot of value in value-oriented stocks. There are many high-quality profitable companies that are trading for a fraction of the market’s price. As future returns from price-rich growth shrinks, we believe more investors will re-evaluate these underpriced and underappreciated companies in search of superior future return prospects. We find it hard to believe that the relative performance between growth stocks and value stocks can continue much further.

The gap between the performance of value-oriented stocks and growth stocks was already stretched to historical highs entering 2020. This gap has blown out to new records following the emergence of the pandemic where capital intensive cyclical businesses saw large declines and tech and healthcare stocks raced into the stratosphere.

The polarization between growth and value is even more dire than the Nifty 50 periods of the Late 1960’s or the dot-com bubble of the late 1990’s. But it is worth noting that in these prior instances, investors had written off value stocks as “old economy” stocks doomed to fail in the new economic paradigm. Sound familiar?

Yet without warning in both instances, value stocks ultimately defied these expectations and the outperformance of growth stocks quickly vanished to the astonishment of the new economy crowd. It is important to remember that no one rings the bell at the top, both the Nifty 50 and internet stocks seemed to be crushed under their own weight without a meaningful catalyst to point to. These stocks simply stopped going up.

Finally, a note on optimism

We believe the theme for 2021 will be optimism. Society is poised to emerge from isolation and deprivation wrought by the global pandemic. We collectively faced a crucible, and while it still may be hard for many to recognize it, we are all stronger and better prepared for the future. The plain reality is that the world was on fire in 2020, yet we are still here. While humans might not like change, our adaptability and resiliency will always win the day.

Looking back at the pandemic, it may prove to be a blessing for society, providing the trigger that shakes us out of the funk we have found ourselves in since the financial crisis. The digitalization of work and productivity is a boon for workers everywhere as many are finally free of the 9-5 grind and daily commute to a large stuffy office building. The interior of the country will have a renaissance as high-quality jobs no longer require a cubicle in unaffordable city centers along the coasts. Suddenly, the immense challenge and costs of reversing climate change seems less daunting. Most importantly, we have unlocked a medical miracle that will have a profound impact on healthcare and longevity; akin to the engineering gains ushered in by the space race of the 1960’s.

Concentrated Value

The Concentrated Value portfolio had another outstanding quarter. The total return for the portfolio was 19.1% in the fourth quarter; 7.0% better than the 12.1% total return of the S&P 500 index. Our exposure to cyclical and energy stocks drove most of the outperformance. These sectors had substantially lagged the market since the crash in March and they quickly closed the gap once it became clear that a viable Covid vaccine candidate would be available in 2021.

We initiated our energy position in early November and saw quick gains in both Diamondback Energy (+47%) and Texas Pacific Land Trust (+35%). We believe these are the two highest quality companies in the market with exposure to oil prices.

Diamondback (FANG) is the lowest cost producer of US shale oil in the prolific Permian Basin of West Texas. We believe they can profitably drill for shale oil at a price somewhere between $40-$45 per barrel, substantially below most other E&P companies and even the oil majors like Exxon and Chevron. They are one of the few remaining independent E&P companies with a large Permian footprint that hasn’t been acquired yet.

Texas Pacific (TPL) is a unique player in the oil industry as they are one of the largest landowners in Texas. Their operations consist of leasing the drilling rights on their property to other third-party E&P’s. TPL receives a royalty for every barrel that others pump on their property without having to invest one penny in the drilling or extraction process. They have a pristine balance sheet and none of the operational risk associated with traditional E&P’s. We believe an ownership position in TPL is the safest way to invest in US shale. They will benefit as oil prices increase and drilling resumes on their lands. At the same time, should oil prices fall, their stock price will hold up much better, limiting our downside exposure.

We acknowledge that energy prices were a large source of losses in the first quarter as we had a too large exposure to the sector. With that understanding, we have been thoughtful about properly sizing our position in energy to make sure we don’t have excessive exposure to any single factor, such as oil prices. Additionally, we have deliberately selected securities that should have less downside risk if energy prices decline sharply again.

We believe energy stocks could be one of the best performing stock sectors in 2021. Energy securities are still widely out of favor and trailed the S&P more than any other group in 2020. We are seeing many signs that the oil market could be very tight in the second half of 2021 as vaccinations allow normal activities to resume, raising demand for oil supplies. The elevated levels of oil in storage that resulted from the combination of the Saudi-Russia price war and pandemic quarantines have quickly dissipated to normal levels. Production remains well below pre-pandemic levels and under-investment will make it very challenging for the industry to boost production to pre-Covid levels should demand recover.

Within the cyclical sector, our largest winner in the quarter was Capri Holdings (CPRI). Shares of CPRI jumped an amazing 134% in the quarter. The company had just completed a multi-year turnaround prior to the pandemic and shares that had lagged for years were dumped by investors during the pandemic. CPRI has benefited from the restructuring and they are well positioned for a recovery in luxury spending that materialized this fall. We believe the stock is still well below its intrinsic value of nearly $70 per share, and it remains our largest position.

As we promised in our last letter to investors, we put our cash to work this quarter. We entered the period with 19% still in cash and exited the year with just 2% in cash. We are once again fully invested. In addition, to our new stake in the oil companies, we initiated a new position in Alamos Gold (AGI), Altria (MO) and Teradata (TDC).

Alamos is a mid-cap Gold Miner with three operational gold mines, all in good locations. Their two flagship mines are in Canada, and the third smaller mine is in Mexico. The largest mine, Young-Davidson, will increase production by 40% in the 4th quarter. Their second largest property, the Island Complex, has a $500 all in cost and reserves in place to expand capacity by 70%. Shares had fallen recently as gold prices retraced from $2,000 down to $1,800 and investors took recent gains. We believe this dip has given us an opportunity to build a position in one of the highest quality gold miners in the industry with world-class assets in a geopolitically safe country.

We initiated our position in AGI stock at $9.40 and we believe that shares are worth between $15-20 at the current gold price. This valuation would be much more if gold prices move higher than $2,000. The company has a $3.7 billion market cap with a net cash balance sheet. Free cash flow is set to grow to $200 million annually. Management has indicated they will pay out all free cash flows to shareholders via dividends.

Altria is the largest tobacco producer in the US, representing the American operations of Philip Morris with major brands including Marlboro cigarettes and Copenhagen and Skoal chewing tobacco. Altria is a cash flow machine that sells an addictive product that allows them to raise prices each year, more than offsetting the inevitable decline in cigarette volumes. The company pays an 8% dividend yield and carries a P/E valuation multiple just shy of 10x.

We expect Altria to continue to be able to press pricing and even grow their nicotine alternative business. The health concerns surrounding vaping have also lessened the competitive threat posed by vaping start-up companies like Juul. Altria made an ill-timed investment in Juul that proved to be an expensive error, but their investment has been almost entirely written off and shouldn’t represent a headwind moving forward.

We believe in the current low-rate environment that the sustainable cash provided by Altria’s dividends are worth significantly more than 10x earnings. We believe shares are worth between $55-$70. We bought our position at $43 and believe it would be difficult to see shares re-rate much lower, providing a nice margin of safety. Collecting an 8% yield as we wait for the valuation to rerate higher is an additional benefit.

Teradata is a database management company with a software offering that allows customers to deploy big data analytics across their multiple database platforms that are currently run on-premise or in the cloud. They have relationships with all three main cloud vendors and have had success moving clients from on-premise to cloud environments.

TDC is in the process from moving from an older perpetual license revenue model to a new ratable subscription model. These revenue model transitions have historically created excellent investment opportunities as this transition wreaks havoc on financial statements for several years. TDC is already several quarters into this transition and has already transferred 80% of their business to the new ratable subscription model. They are beginning to realize substantial free cash flow and revenue growth under the ratable SaaS model.

We expect earnings to move above $2 per share in the next few years and grow at double digit rates thereafter as the end market for their service is booming, and their product has been awarded industry-leading service ratings from Gartner, a premier IT consultancy. We believe we are paying just 11x normal earnings with shares trading hands at just $23. We think it is possible for shares of TDC to double over the next few years from earnings growth and a higher valuation multiple. The company also has a pristine balance sheet with just $100 million in net debt.

We sold our positions in Abbott Labs and UPS on success during the third quarter. We acquired shares of these two companies in the depths of the downturn in March. It was difficult to sell our stakes in these high-quality compounders, but valuations had stretched well ahead of our most optimistic calculations of their intrinsic values. Should either company stumble, we would jump at the opportunity to own them again.

Lastly, we wanted to revisit the Investment Philosophy of the Concentrated Value Portfolio. We utilize a value investment strategy that seeks out companies for investment which the Portfolio Manager deems to be high quality companies. Quality is defined by possessing business operations with durable competitive advantages, allowing for high returns and growing cash flows streams. We want these high-quality companies to also have solid balance sheets, preferably with a net cash position. We also prefer that their management teams make decisions with an emphasis on maximizing shareholder returns.

Once we find these high-quality companies, we generally only invest in their stock if they trade at a steep discount to our estimate of their intrinsic value. This is necessary to provide our investors the opportunity to generate an above market return and protect capital. This discipline creates a wide margin of safety if an undesirable scenario plays out in the future. Pelican Bay Capital Management believes that identifying a significant difference between the daily market value of a security and the intrinsic value of that security is what defines an investment opportunity.

Dynamic Income Allocation

The Dynamic Income Allocation Portfolio (DIAP) once again generated excellent risk-adjusted returns in the fourth quarter. The total gain for the DIAP including dividends was 7.2%. The portfolio also delivered on its low volatility mandate with the average daily moves of just 0.11% and standard deviation of 0.42%. Amazingly, the portfolio only experienced daily moves of more than 0.5% (up or down) on 14 out of 64 trading days in the quarter. The DIAP’s high return on minimal volatility resulted in a Sharpe Ratio of 4.1x for the fourth quarter. We are enormously proud of these results and delivered on our mandate to investors.

The portfolio has now demonstrated 3 strait quarters of elevated sharp ratios as we deliver strong positive returns with low volatility. The changes we made to the portfolio construction methodology, including new rules around position weights, have enabled us to deliver these excellent results and get the portfolio back on track after March.

None-the-less we are still deeply disappointed with the full year return of -6.3%. As a reminder the DIAP was struck by a collapse of MLP stocks over 2 trading days in early March where the MLP index fell 50% on the back of the Saudi-Russia oil price war and initial pandemic lockdowns. This black swan event resulted in the MLP asset class contributing to a onetime minus 12% shock to the DIAP portfolio.

These events caught us off guard and we took the opportunity to implement new portfolio weighting rules to ensure we do not endure another shock like that in the future. After all, the primary objective of the DIAP is to provide elevated income with low volatility. We were simply taking too much idiosyncratic risk under our prior position sizing scheme and the pandemic made this unknown flaw in our portfolio construction process painfully obvious. If the new portfolio guidelines were in place in March, the portfolio would have returned +6% for the year instead.

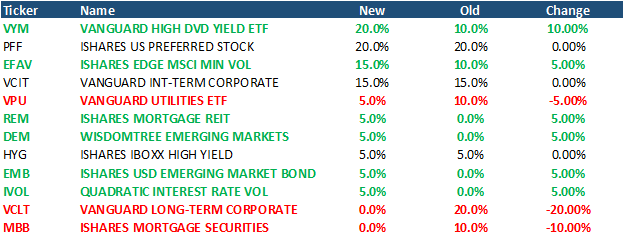

Turning back to the current portfolio, the DIAP had an active quarter as we undertook a significant tactical rebalance and transitioned away from our Maximum Protect portfolio allocation. In October it became clear to us that rock bottom interest rates could reverse causing losses for longer duration fixed income assets. At that time, we exited our position in Long-Term Corporate Bonds and Mortgage-Backed Securities, that combined represented 30% of our portfolio.

Following the outcome of the Presidential Election and vaccine results from Pfizer, we concluded that the US dollar would likely weaken, global economic growth would accelerate in 2021, and interest rates would rise. Under this scenario value equities, international assets and commodities should outperform. With these assumptions guiding our outlook we rebalanced the DIAP by adding to US value stocks, International stocks, Emerging market stocks and bonds, as well as Mortgage REITs. The table below displays the DIAP’s new portfolio allocation.

The adjustments to the DIAP had an immediate impact and the portfolio, as it climbed 5.5% in the days after the rebalance, representing most of the returns for the quarter. Incredibly, the DIAP even outpaced the S&P 500 in an upmarket over this time frame as the S&P 500 gained 4.4% between November 10th and the end of the quarter.

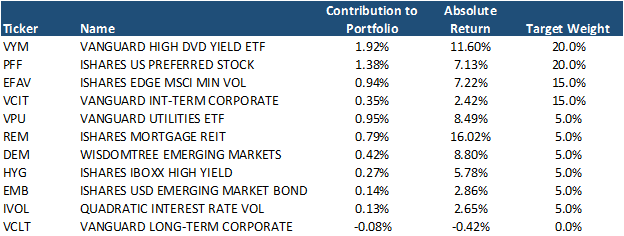

The best performing asset class in the quarter was Mortgage REITs which gained 16% contributing to a 0.8% of the quarter’s gain. Mortgage REITs were tremendously undervalued at the time of our purchase and they are poised to benefit from a steepening yield curve and economic recovery.

From a contribution to the portfolio perspective, US Dividend Stocks added 1.9% to our return as the asset class grew 11.6%. We expect outperformance from these value-oriented stocks to continue, at least in the near term, as they remain undervalued and typically perform well during times of economic recovery. The performance of each asset and its contribution to the portfolio can be found in the table below.

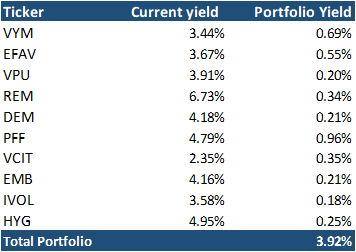

The current yield on the DIAP following the portfolio rebalancing stands at 3.92% as of this writing. This is an increase from the 3.2% yield on the portfolio under the Max Protect prior to initiating the transition. The current dividend yield for the DIAP remains at a substantial premium to US treasuries which are currently yielding just 1.1%, representing a 2.8% spread.

Lastly, it is important to reiterate the investment philosophy of the Dynamic Income Allocation Portfolio. The DIAP is designed to function as the core foundation of an investor’s portfolio by operating with the dual mandate of generating the highest current income possible while preserving capital.

Pelican Bay Capital Management attempts to achieve this dual mandate by only investing in asset classes that by themselves offer a current dividend yield that is greater than either the dividend yield of the S&P 500 or 10-year U.S. Treasury. In our view, elevated income can add stability to a portfolio and maximize the benefits of compounding through reinvestment.

We then construct a portfolio of these high-yielding asset classes with an emphasis on minimizing correlation of the overall portfolio and maximizing its diversification beyond the typical 60/40 stock/bond portfolio. We finally add a valuation overlay that we utilize across all our portfolios. We allocate a larger position weighting to the most undervalued and attractive investment opportunities, while avoiding owning overpriced assets.

Phoenix Fund

Please note: The Phoenix Portfolio is only available to “Qualified Clients” pursuant to section 205(e) of the Investment Advisors Act of 1940 and section 418 of the Dodd-Frank Act.

The performance of the Phoenix Fund this quarter was exceptional. The total return was 16.3% for the third quarter, easily outpacing the S&P 500’s gain of 12.4%. Most of our investments produced solid gains in the quarter with 4 companies doubling in value: Endo Pharmaceuticals, Coty, Village Farms and Rayonier Advanced Materials. We are also pleased to report that the strong gains we saw in the back half of 2020 have continued into the new year.

As we entered the quarter, the forward contracts for the VIX Index were pricing in increasing levels of volatility for the months of November and December. We continued to have a hedge in place to protect the portfolio should this volatility materialize and cause a risk off environment. This hedge was once again our largest drag on performance and cost us 7.9%. Excluding this hedge our portfolio would have returned 24.2% in Q4. We removed the hedge following the election outcome and Pfizer vaccine announcement. We remain unhedged entering the new year and have no short position.

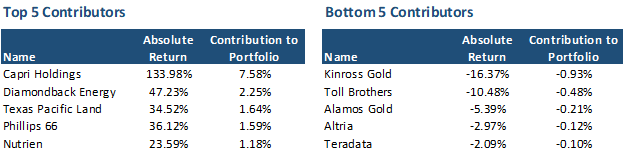

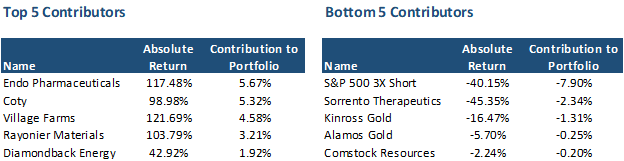

As you can see in the table below of our top and bottom contributors to returns, many of our winners were new companies that we added to the portfolio in the fourth quarter. We were much more active than normal, initiating 8 new positions, while selling six of our holdings.

We exited our position in Asure Software and FreightCar America on success. We also sold Francesca’s in the quarter after we concluded that the new CEO might choose to continue the company’s restructuring process in bankruptcy. The company ultimately did file for bankruptcy after we exited. We also sold our position in Sorrento at a loss after the vaccine trial success from Pfizer and Moderna severely curtailed the future demand for their Covid treatments.

As we discussed in our third quarter letter, we did ultimately decide to reinitiate a position in ADT after selling our shares on success in Q3 for approximately $16 per share. We reinitiated our position at just $7.81. We still believe that ADT is worth $12-$16 per share and are thrilled that we get a second chance to own this company. Hopefully the second go round will be as profitable as the first.

We also initiated new positions in Alamos Gold (AGI), Braemar Hotels (BHR), Coty (COTY), Diamondback Energy (FANG), Whole Earth Foods (FREE), Sabre Corp (SABR), and Village Farms (VFF). We will discuss our investment cases for Coty, Village Farms and Braemar below. You may find the bull thesis for Alamos Gold and Diamond Back Energy above in the Concentrated Value section.

Coty is a manufacturer and marketer of branded makeup and skin care products that has struggled under poor management and too much debt for the last 10 years. The Covid pandemic compounded Coty’s issues as quarantines and virtual work caused a significant hit to demand for makeup. Coty shares fell to just $3 as institutional investors liquidated the shares.

However, we believe Coty has positioned themselves well to emerge stronger from the pandemic and it is likely that makeup sales rebound as the work from home movement ultimately subsides. Coty also brought back its founder and replaced management with veterans from L’Oreal, a well-run competitor. They also signed a JV distribution agreement with celebrity Kylie Jenner. The opportunity to distribute the Jenner brand internationally should power growth and profits for several years. Lastly, they have pivoted to an emphasis on skin care which has better future growth prospects and carries higher margins than makeup.

Coty’s recovery appears underway as cost savings and a sales rebound resulted in a return to profitability in the third quarter of 2020. We expect further financial improvements as the economy recovers from Covid in 2021. Their debt is termed well and appears manageable. Coty should easily avoid any risk of bankruptcy and debt should fall by 1-2 turns of debt/EBITDA in 2021. We expect shares to rebound to the $8-12 level as investors realize a similar conclusion.

Village Farms is a greenhouse owner that grows vegetables. They are transitioning their business to grow and market cannabis. They have been in business for 30 years and have large greenhouse facilities in British Columbia (4.8 million square feet) and Texas (5.7 million square feet). Despite being the only profitable Canadian pot company and having 13% market share, Village is not well known by cannabis investors. We believe this is because their roots as a vegetable grower meant they were covered by farming & agriculture analysts as opposed to cannabis analysts. Because of this mismatch in analyst coverage, most cannabis reports produced by Wall Street leave out Village Farms.

However, this is poised to change as Village Farms has acquired 100% of their JV interest in Pure Sunfarms, which is their cannabis operation serving Canada. Village will begin consolidating Pure Sunfarms results on their financials beginning in the fourth quarter and revenues will grow by 50% next year. Because most Canadian producers lose money, their stocks are typically valued on a multiple of sales. Recently, pot companies have been trading in a range of 2.3-3.0x revenues. Conversely, Village Farms was trading at just 1.3x sales, and this figure didn’t include the sales attributable to Sunfarms. Now that Sunfarms revenues will be included in Village Farms financials, the stock should re-rate to their peer multiple. We wouldn’t be surprised if it moves to the top end of the range as investors recognize that Village is taking huge chunks of market share from these competitors.

Village is growing much faster than their peers and has taken market share from all of them in the third quarter. They now account for 13% of the Canadian retail cannabis flower market and are poised to grow to 20%. Their lower production costs from operating wholly-owned greenhouses has allowed the company to materially underprice competitors in the marketplace. Village is selling their cannabis for $3.54 per gram at retail versus peers at $8-$16 per gram. Village can do this as their all-in production and distribution costs are just $0.80 per gram.

Village also offers investors two free call options that could benefit its shares. First, they have recently completed a production facility that can refine cannabis flower into consumables like gummies. If their consumable products are as successful gaining share as the traditional pot business, it would significantly add to their revenues. Secondly, with their large footprint in Texas they would be ready to take substantial share in Texas should the state legalize or federal government de-criminalize marijuana. For comparison, the estimated market size of Texas would be greater than the entire country of Canada.

We acquired our shares for just $4 and they have quickly jumped to $13 per share as investors. We believe the company is worth $13-20 per share, and potentially much more should the Texas cannabis market become a reality.

Our newest position is Braemar Hotels & Resorts (BHR). Braemar is a niche hotel operator that owns 13 hotels including 8 ultra-luxury resort properties and 5 luxury urban center properties. Braemar has fortified their balance sheet and is poised to recognize a strong recovery as luxury leisure travel rebounds sharply in the second half of the 2021. There are several clear signs of elevated demand for leisure travel and Braemar’s resort properties have all reopened with recoveries in revenue per available room (RevPAR) that is widely outpacing other hotel companies. We believe their properties are irreplaceable landmark hotels such as the Ritz-Carlton St. Thomas, Park Hyatt Beaver Creek and Capital Hilton in Washington DC. They do not have one bad asset.

The balance sheet is well termed with no debt due until 2022 and only $324 million in maturing obligations before 2024. Their net debt is just 45% of the estimated net asset values of their trophy properties. All debt is collateralized by an individual property and non-recourse to the parent hotel company. We bought our initial shares at $4 and believe that the company is worth $9-12. To put the current price in perspective, prior to the pandemic Braemar had an Adjusted Funds from Operations (AFFO) of $1.40-$1.70 per share and paid a $0.64 annual dividend. We believe that Braemar will fully recover and could achieve their prior financial performance by sometime in 2022, giving us an entry price of less than 3x AFFO or a 16% dividend yield.

Finally, we wanted to revisit the investment philosophy of the Phoenix Fund. The portfolio takes advantage of structural biases against institutional ownership of financially levered companies with low-stock prices. We seek companies that have had their stock prices fall 70% or more in the last two years and are priced below $10 dollars per share. This outcome typically leads to forced selling from their institutional shareholders, creating the opportunity to make outstanding investments for less constrained investors.

Generally, these companies are under distress from poor performance caused by what we believe are temporary factors. These companies typically have elevated levels of debt, and any prolonged period of business stress could cause stockholders to endure substantial losses. The Phoenix Fund is a high-risk, high-return investment strategy. Please see the Risk of Loss Section of Part 2A of Form ADV referenced below.

On the operational front, Pelican Bay Capital Management has brought on Grant Hamel as an Equity Research Intern for the Spring of 2021. Grant is currently a Junior at the Tulane University in New Orleans pursuing a major in Business. Grant is also a member of Tulane’s Division One Football Team. Despite the demands of being a student athlete, Grant has also excelled academically. This fall, Grant will be tasked with researching publicly traded companies in the retail industry for potential investment.