To view this letter in PDF Format please click here: 2019-Q4 PBCM Investor Letter.pdf

Dear Investors;

We would like to wish all of our clients and their families a prosperous and healthy New Year. We thank each of you for your continued support and trust in us to manage your capital with skill, discipline and integrity.

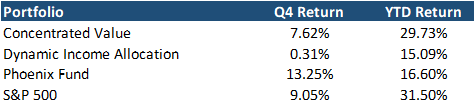

As the new decade commences, we are celebrating our first full year in business. Pelican Bay Capital Management is pleased to report our inaugural year was very successful. We delivered on our investment mandates and objectives. We continue to focus on the long-term and provide superior risk-adjusted returns for our investors.Our quarterly results and year-to-date results for each portfolio and the S&P 500 are in the table below.

The layout of this quarter’s letter will start with a general market commentary, followed by individual reviews and analysis of each of our portfolios including Concentrated Value, Dynamic Income Allocation, and the Phoenix Fund.

As always, if after finishing this letter you have any questions or would like to discuss any topics in greater detail, please don’t hesitate to call us at 239-738-0384 or send us an e-mail at tyler@pelicanbaycap.com. We welcome your feedback and look forward to your correspondence. Additionally, we encourage you to share our letter with as many friends and colleagues as you like.

Market Commentary

Asset values increased markedly in the fourth quarter of 2019. Stocks performed exceptionally well with the S&P 500 producing a 9.1% total return led by large-cap technology stocks. Interest rates moved up from the lows in August but remain well below levels from one year ago. Almost every asset class performed well in the fourth quarter with the sole exception of energy-related securities, despite oil prices rebounded sharply. Even CCC-rated junk bonds finally participated in the rally after trailing other debt categories in the first 9 months of the year.

We believe the renewed optimism from investors is justified. Most notably, it is becoming clear that the slowing macroeconomic data that materialized over the summer appear to reflect another cyclical slowdown in the current elongated economic expansion, not a full-blown recession as many feared.

As we stated in last quarter’s Q3 Investor Letter, it was our view the we were only experiencing a cyclical slowdown (the third of this economic expansion). If there wasn’t a larger negative shock to the fragile economy, we thought a recession could be averted and economic growth could reaccelerate. Fortunately, the big geological events that we feared could create a significant enough negative shock to tip the United States into a recession were each resolved favorably in the fourth quarter.

Most importantly, the deteriorating trade rhetoric underscored by the US-China trade war is finally easing. In November, the US and China announced that they have reached a “Phase 1” trade deal. Crucially, additional tariffs that were planned for in December were scrapped by the President, and some previously implemented tariffs were also decreased. These larger tariffs, if applied, would have broadly impacted consumer products resulting in higher prices and weakened consumer spending. This would have directly struck at the main pillar keeping the economy out of a recession; the strong consumer. Although large tariffs on a significant value of capital goods remain in effect, these tariffs are less noticeable to consumers and we are relieved the situation is no longer deteriorating.

During the fourth quarter, the US also let the allowable time frame to impose new punitive tariffs on European goods lapse without taking any action. We were worried President Trump was prepared to levy large tariffs on European Automakers that would have surely invited retaliation and opened a new front in Mr. Trump’s tariff wars. We believe this action could have further eroded business confidence and severely hurt consumers.

Additionally, the US congress finally ratified the New NAFTA trade deal (USMCA). The decision to renegotiate the NAFTA trade agreement and expose the ratification to partisan politics created unnecessary levels of uncertainty for manufacturers that have largely integrated supply chains with our two largest trading partners. The ratification of USMCA allows businesses to confidently plan for their manufacturing operations across the US, Canada and Mexico. We believe many capital investment decisions had been put on hold pending the final ratification of the USMCA trade agreement.

Even the potential for a hard Brexit declined following the conservative party’s landslide victory in the recent UK Parliamentary Elections. There has been a sharp rebound in the British Pound Sterling as capital has begun to flow back into the country and business confidence indicators are improving. It was our opinion that the negative risks surrounding a hard Brexit were wildly overstated by some market commentators. But at least for now we don’t have to test that theory as an orderly Brexit has become the most likely outcome.

With the resolution of these uncertainties, we believe the prospects that economic growth reaccelerates in 2020 have improved markedly. The economy should exit the current cyclical slowdown we have been experiencing. We are already seeing evidence of manufacturing recoveries in China and Europe. The US yield curve has steepened after a temporary inversion of the two- and ten-year Treasuries. The amount of negatively yielding debt has retreated from $17 trillion in August (an astounding figure) to $11 trillion by the end of the year.

Of course, an unseen black swan event such as a negative geopolitical event or major cyber-attack at an important financial institution could occur and derail consumer confidence enough to push us into a recession. We have no way to forecast these unknowable events. However, the mounting challenges we were aware of that had ourselves and other investors worried have at least subsided for now.

Outlook for Markets in 2020

We are not in the business of regularly producing short-term market forecasts. At Pelican Bay Capital Management, when we think about what might happen to asset prices in the near-term, we consider several potential outcomes to significant market fundamentals and assign a probability to each, resulting in several possible scenarios with accompanying possibilities.

Occasionally, we have greater confidence in the probability of certain scenarios evolving that are widely differentiated from existing market expectations, and thus not correctly priced into asset valuations. When this is the case, we think it is worth sharing these views with our investors as they will impact how we position our portfolios for the near-term. These decisions can create significant financial returns if the non-consensus scenario unfolds. But the key is to remain cautious with the full knowledge that no one can predict the future and the consensus market view could be right.

For example, at the beginning of last year we thought the 2018 sell-off was driven by excessive tax-loss harvesting. We expected a sharp rebound in the early parts of 2019 as the tax-loss selling abated with the start of a new tax year. Consensus wasn’t calling for a sharp rebound, but we saw low valuations, forced selling, and a strong consumer economy; essentially the recipe for a rebound in stock prices. Similarly, we have held a more bullish view on oil fundamentals than the market and have elevated exposure to energy-linked assets (we will revisit our energy thesis below).

As we kick off a new calendar year, we find ourselves in another situation where we believe the potential outcome of US equity returns in 2020 is much greater than market consensus. We believe the market is expecting muted US stock performance as valuations are elevated at 18.5x earnings per share and there are consensus forecasts for little or no earnings growth.

We do agree with consensus that the market valuation multiple is on the high side of fair value given current low interest rates, and probably will remain stable. However, we believe that earnings growth expectations are far too pessimistic. Most strategists are forecasting flat to low single digit earnings per share growth. We think these views are being tempered by recency bias as S&P 500 earnings growth was flat in 2019. We think the odds are high that earnings growth outperforms expectations and end the year up 8-12%. This should result in another year of above average returns for US stocks. What is driving our elevated views?

Falling US Dollar

First, we believe the US dollar will finally weaken in 2020. A weakening dollar results in greater US exports, stronger manufacturing, and higher foreign earnings translated back into dollars. For example, in the last 2 years a strengthening dollar has cut approximately 4% annually from EPS growth in the S&P 500, where roughly half their sales are to foreign markets. A weak dollar is a strong tail wind for S&P 500 earnings growth and vice versa.

We think the US dollar strengthened in the last two years for two principal reasons. First, the Federal Reserve had initiated a quantitative tightening policy that was pulling dollar liquidity out of the financial system. At the same time President Trump’s increasing use of tariffs and sanctions caused global trade flows to shrink for the first time since the Great Recession. Shrinking trade resulted in less dollars available to our trading partners as approximately 70% of international trade is settled in US dollars. Combined, these two impacts resulted in a dollar funding shortage causing the value of the greenback to jump. This dollar shortage likely also had a role in the October dislocation in the repo markets; but that’s a very complex topic and we’ll leave that analysis to the money market experts.

Beginning in the fourth quarter of 2018, these influences began to reverse, and the US dollar quickly declined by 3%. As we discussed above, elevated tariffs are being removed and we have more certainty surrounding the implementation of the USMCA and the avoidance of a hard Brexit or European Tariffs. We believe these events will result in a rebound in global trade flows in 2020.

At the same time the Federal Reserve has reversed course and is pumping cash back into the economy at a much greater pace than their prior quantitative tightening initiatives. Some observers have dubbed the Fed’s latest stimulus as “QE4” or the fourth round of quantitative easing. We see the dollar shortage that dominated 2019 quickly reversing, and there is already evidence it is decreasing the value of the US dollar.

We think it is possible that the dollar will continue to fall another 3-6% in 2020. This would essentially retrace the upward gains caused by the dollar shortage. Considering the existing fourth quarter drop in the greenback of 3%, further declines in line with our scenario could add 3-5% to earnings growth in 2020.

Manufacturing & Capital Investment Rebound

One of the side effects of the geopolitical and tariff worries that arose last year was that business leaders dialed back on their capital expenditures (CAPEX). A survey of Chief Financial Officers (CFOs) by Duke University this fall found that 56% of CFOs were preparing for an imminent recession. Another survey from Deloitte found that CAPEX spending would grow by just 3.6% in the next twelve months, down from expectations of 9.4% growth in their prior survey. Business investment has been shrinking steadily and helped to create the cyclical slowdown we discussed previously.

Looking to 2020, we remain positive on the economy as job growth and wages continue to rise, particularly in lower paid jobs where wages had been stagnant for most of this business cycle. Those unemployed that had previously abandoned looking for work are finally re-entering the labor force. More jobs and higher wages suggest further consumer strength like a positive self-reinforcing loop. Finding more workers at existing wages will become more challenging. We believe that companies will have to increase CAPEX to meet increasing consumer demand. This is especially the case given tighter labor constraints combined with aging capital equipment and increasing factory utilization.

Simultaneously, the Fed’s rate cuts this summer are starting to positively impact the interest rate-sensitive parts of the economy like housing and auto manufacturing. In 2020, home builders are poised to deliver the greatest number of new homes since the downturn started in 2006. The falling dollar, reduced retaliatory tariffs, and improving economies in Europe and China will also contribute to higher US manufacturing output. A continuation of the ban on flying the Boeing 737-Max could be the biggest potential detractor from manufacturing growth, but we think the FAA clears the plane by spring.

Considering all of these factors, we believe business spending, which was a negative contributor to last year’s economic output, may well provide an unexpected boost in 2020. We think there is a reasonable probability that a manufacturing expansion could add 2-3% to EPS growth for the S&P 500.

Lastly, we think healthy consumer spending, continued stock buybacks, and higher commodity prices could result in another incremental 2-4% growth in EPS. When we add everything up the result is a scenario with 8-12% earnings growth in 2020. This is significantly higher than the consensuses view. If the market multiple remains at 18.5x or moves higher to 19.5x in an improved economic climate, we should see higher than expected returns for US stocks in 2020. We think this scenario would result in value-oriented cyclical stocks and energy assets outperforming.

Long-Term View Unchanged

However, our long-term view on total equity returns remain challenged. While value stocks look cheap, the overall S&P 500 earnings valuation multiple is still on the upper end of our fair value range given subdued interest rates. From the current level of 3,200 we believe that long term investment returns could be as low as 2-5% over the coming decade; much less than the 13% annualized we achieved over the last 10 years.

Given these low expectations, we believe the opportunity to produce superior returns over the next decade, lies in the combination of owning: (1) value stocks vs. growth stocks, and (2) securities with higher dividend yields. Nevertheless, income will make up a much larger portion of total returns from here. Investors that maximize income will be much better off. Our portfolios are positioned well for this long-run outcome.

Energy Market Narrative Turning?

In our letter from the third quarter of 2019 we discussed at length the false market narrative that we believed was suppressing energy security valuations. For a full review of our thoughts on the topic we ask you to please revisit our last letter that can be found on our website at pelicabaycap.com. However, in the following paragraph we offer a brief summary of the key points from that letter.

Last quarter we wrote that it was our view that the extreme pessimism concerning energy stocks and oil prices was driven by the widely held market narrative that: (1) Shale Oil Producers can make money at $50 per barrel, and (2) at this price they have the capacity to increase production by over one million barrels per day each year. However, incoming data didn’t support these views, and it was clear to us that it represented a false narrative. Unfortunately, some market narratives are so pervasive that they can sustain themselves in the face of overwhelming contrary evidence. At the time we expressed these views, there was very few market observers that shared our philosophy.

But over the course of the 4th quarter, the narrative finally started to be questioned by some investors and business writers. At first, we saw a handful of articles published on energy related blogs and some specialized websites. Some braver oil strategists started to lower their 2020 shale production growth outlooks below 1 million barrels per day.

Then, our energy views started showing up in articles published by serious media outlets including Bloomberg News and the Wall Street Journal. Here is a sample of some headlines:

- “Peak Shale: How U.S. Oil Output Went from Explosive to Sluggish” – Bloomberg

- “Shale Boom is Slowing Just When the World Needs Oil Most” – WSJ

- “Frackers Prepare to Pull Back, Exacerbating a Slowdown in US Oil Production” – WSJ

- “Texas Oil Explorers Say Predications of Growth Contradict Dire Reality” – Bloomberg

We believe consensus is gradually transitioning towards our bullish energy views. It is becoming clear to more people that the era of seemingly unlimited growth in US shale is likely over. We are finally starting to see consensus forecasts for US shale growth for 2020 be revised to much lower levels. These shrinking estimates are still far too high as we think the US can’t sustain anywhere close to one million barrels per day of production growth with just 670 rigs. In fact, we think it is possible that there are year-over-year US production declines at some point in the first half of 2020.

Simultaneously, the world’s conventional oil supply excluding US shale is about to enter a phase of sustained decline as the last major oil projects commissioned in the days of $100 oil prices are finally being brought online. These mega-projects take as long as 5-7 years to reach first production from start to finish. These oil projects had essentially kept conventional oil production flat since 2015, offsetting natural declines in most oil fields. But this won’t be the case after 2020.

The lack of new conventional projects beyond 2020 combined with slowing US shale growth will likely catch the world by surprise and usher in a new era of oil scarcity and higher prices. More market participants are waking up to this reality. We think 2020 will most likely be the turning point for oil prices and energy stocks.

Concentrated Value

We are very pleased with the performance for the Concentrated Value Portfolio this quarter, and for the full year. Despite a 25% exposure to lackluster Energy Stocks, the portfolio generated a 30% total return, keeping pace with the S&P 500’s rise, and finishing ahead of the 26% return from the Russell 1000 Value Index.

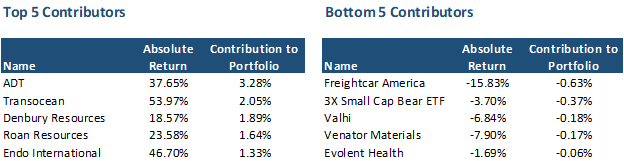

As we analyze the holdings in our portfolio, we are very optimistic for continued success in 2020. We own several high-quality companies that trade for valuation multiples that represent a significant discount to the market. Fifteen of our twenty stock holdings are non-energy companies, and of this group, 9 trade for less than 10x earnings. The dividend yield for the portfolio is 3.6% that is almost double the yield offered by the S&P 500. In our opinion, there is plenty of upside left in our current holdings, even if oil linked equities remain out of favor.This quarter’s positive investing results were broad based with every sector finishing the quarter in positive territory. Nineteen of the twenty-one stocks we owned in the quarter finished in the green. Our only two laggards were Toll Brothers and Floor N Décor. These two companies were our best performers in the 3rd quarter so it is not surprising to see them take a breather.

We are still very positive about Toll Brothers as it remains cheap despite the 28% return since we took our position. Home builders did well last year as the housing recovery unexpectedly accelerated. The 75-basis point cut in the Federal Reserve overnight rate brought the thirty-year mortgage rate near record lows this fall. This led to a pickup in new home construction. We think the recovery in home building has a long way to run as new housing units have not kept pace with population growth or family formations.

Floor N Décor (FND) has been one of our strongest performers since inception. It was a volatile year for the company with the on-and-off again cadence of tariff threats. As we have written in prior letters, we believe FND has a superior business model relative to the competition and a long runway for growth. However, the price is becoming very rich and if it moves up much further from here, we will likely have to consider replacing it with a cheaper stock with more upside potential. At $50 per share, FND’s stock is already pricing in very healthy growth.

The best performer in the quarter was Lam Research (LRCX) which increased 21%. The stock jumped in October as the company reported improving sales of their semiconductor equipment and called for a recovery in the memory CAPEX cycle. At $280 per share Lam is pricing in a full recovery in the semiconductor equipment industry. We think Lam could earn $17-$20 per share in the next upcycle, versus $11 today. A 14.0-16.5x multiple would be reasonable for Lam at the top of the next semi-cap cycle. This would reflect a $280 stock valuation. However, this price is available today despite the recovery being 3-4 years away. Thus we exited our position in Lam. Overall our ownership of Lam was a very pleasant experience. We more than doubled our investor’s money.

We used our proceeds from Lam’s sale to purchase a new position in Capri Holdings (CPRI). The name may be unfamiliar to some readers as it is the result of a name change courtesy of the Management Team at Michael Kors after they purchased Jimmy Choo. Capri subsequently acquired Versace after the corporate rebranding. The company has slumped lately due to a decline in sales of high-end purses and watches at Michael Kors. Capri also struggled with a global slowdown in luxury goods purchases as the Chinese and European economies slowed. The riots in Hong Kong further strained sales as Hong Kong is the preferred destination for inconspicuous luxury shopping in Asia. The headwinds at Capri have left the company with a very attractive valuation of only 7.6x next year’s estimates for earnings per share. The company has little debt and an attractive stable of luxury brands that are difficult to replicate. We also believe there are better days ahead for Capri’s financial performance with sales growth in the high single-digits and positive margin expansion. The valuation multiple should rerate allowing for significant gains.

We entered the quarter with 19 holdings after selling Apple in September. With a mandate of 20 holdings, we initiated a new position in Marathon Petroleum. We acknowledge the portfolio already carries a healthy exposure to Energy related stocks and Marathon will only add to that tally. However, Marathon behaves quit differently from the typical oil companies we already own. In fact, in shorter time periods Marathon benefits when oil falls. This is because Marathon is a refiner, not an upstream oil producer. Marathon is the result of several acquisitions that created a massive refiner, midstream operator, and gas station owner. The opportunity to profit in Marathon lies in the fact that its current value is solely tied to refinery multiples, which trade at substantial discounts to midstream pipeline companies and stand-alone gas station operators. Activist investor Elliott Management has recognized the same conglomerate discount we see. They have convinced the company to pursue a separation of these individual business units with the intention that they will realize their higher stand-alone values post separation. We think the sum of the parts valuation for each of the three units represents $75-$85 per share, which is a substantial premium to the $60 price we paid for our shares.

Lastly, we wanted to revisit the Investment Philosophy of the Concentrated Value Portfolio. We utilize a value investment strategy that seeks out companies for investment which the Portfolio Manager deems to be high quality companies. Quality is defined by possessing business operations with durable competitive advantages, allowing for high returns and growing cash flows streams. We want these high-quality companies to also have solid balance sheets, preferably with a net cash position. We also prefer that their management teams make decisions with an emphasis on maximizing shareholder returns.

Once we find these high-quality companies, we generally only invest in their stock if they trade at a steep discount to our estimate of their intrinsic value. This is necessary to provide our investors the opportunity to generate an above market return and protect capital. This discipline creates a wide margin of safety if an undesirable scenario plays out in the future. Pelican Bay Capital Management believes that identifying a significant difference between the daily market value of a security and the intrinsic value of that security is what defines an investment opportunity.

Dynamic Income Allocation

The Dynamic Income Allocation Portfolio (DIAP) produced lackluster returns for the first time since its inception. We were disappointed with the results this quarter given the positive returns most other asset classes experienced in Q4.

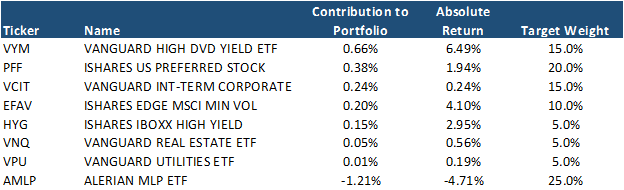

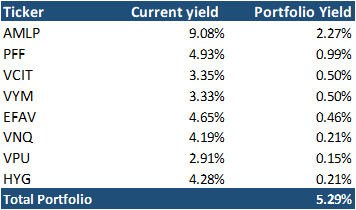

To be fair, we achieved the portfolio’s principal mandate, which is to provide a source of stable returns for investors in most market environments. Our multi-asset class portfolio is thoughtfully designed with uncorrelated assets that should produce elevated levels of income (the yield is currently 5.3%), while minimizing volatility and maintaining a stable principal balance. Unfortunately, the portfolio was too stable, and it underperformed our expectations given the positive outcomes experienced by the broader market.

Once again, the culprit was our Master Limited Partnership position. MLP’s fell 4.7% in the quarter, resulting in a 1.21% drag in the performance of the DIAP. Despite entering the quarter with low valuations, the decline in MLP prices accelerated in the first 2 months of the quarter with the price of the Alerian MLP ETF (AMLP) falling from $9 to as low as $7.68 on December 3rd. The decline appeared to be driven by tax loss selling as MLP’s were one of the few sectors with declines coming into October.

In our opinion, the downward pressure on Pipeline companies was entirely unjustified. In addition to widespread tax loss harvesting in the sector, Investors continue to shun everything related to fossil fuels. We have written several times how the Pipeline companies have dramatically reduced their exposure to underlying commodity prices and have transformed themselves into toll collectors that primarily benefit from increasing oil and gas volumes. To be clear the US needs this energy infrastructure, and that need will only continue to grow as shale resources are developed and refinery and chemical plants expand their production facilities.

The dividend payments that the MLP’s share with their investors has been remarkably stable over the past 3 years despite elevated volatility in oil and gas prices over that time period. None the less, MLP prices move in concert with energy stocks despite the limited correlation with their underlying cash flows.

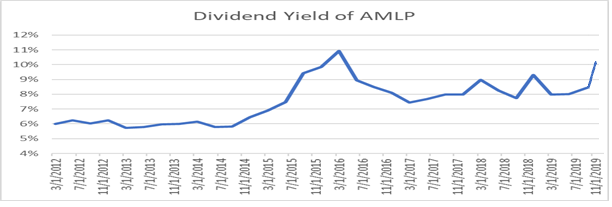

The collapse in MLP prices has caused the yield on these securities to rebound near record levels. The current yield on the AMLP ETF is 9.1%. This yield is near peak levels experienced by MLP’s in the last decade and appears to be an outlier on a historical basis. Since the crash in commodity prices in late 2014, MLP’s have provided dividend yields that averaged 8.2% with a standard deviation between 7.7%-8.7%. Prior to the crash in crude prices, MLP’s yielded a very stable 6%, and this was in line with BB-rated securities during that time period.

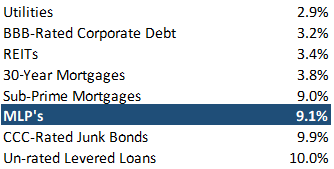

If we consider the fact that a security’s yield is really a reflection of the risk that investors demand to own an asset; then current MLP valuations appear to be a significant outlier in the marketplace. As you can see from the table below, MLP’s are currently offering yields that are in line with distressed assets that have much higher likelihoods of defaulting and a greater degree of variability in their cash flows.

MLP’s cash flow streams look nothing like these shakier asset classes and they shouldn’t be valued in line with the riskiest asset classes in the investment universe. If anyone reading this letter believes that markets are efficient; we offer the prior table as “exhibit A” in debunking that philosophy. MLP’s used to be valued similarly with BBB- or BB-rate bonds, which we agree is appropriate for the risk they bare.

The AMLP ETF currently pays an annual distribution of $0.78 per share. If MLP yields reverted to their historical range over the last 3 years, the ETF would trade at $9-10 per share. If energy prices rise, as we believe they will, and investor’s attitude towards energy related securities recovers, AMLP could return to its 6% yield and the stock price would climb to $13.

It’s hard for us to believe that in a yield starved world MLP’s can stay wildly undervalued for any considerable period of time, and they remain our largest position in the Dynamic Income Allocation Portfolio.

Our positions in high dividend paying stocks in the US and International Markets had the best returns in the fourth quarter. In our opinion, the strong returns are justified and should continue as they appear to be driven by the expected outperformance of value stocks and a shrinking of the valuation gap in non-US stocks. Not surprisingly, after strong returns in the first 3 quarters of the year, utilities, REITs, and investment-grade corporate bonds finally cooled, but still generated positive contribution in the quarter.

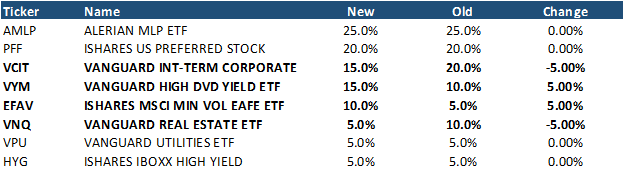

Given our outlook for improved equity valuations in 2020, particularly for high-paying dividend value stocks and international equities, we are adjusting the portfolio allocation for the DIAP. We are reducing our exposure to intermediate-term corporate bonds and REIT’s by 5% each. We are increasing our positions in the high-dividend US stocks and high-dividend international stocks by similar amounts. The changes are highlighted in the table below.

We are making this transition because our expectations of risk vs. return for high-dividend paying stocks is superior to corporate bonds or REITs. Investment grade corporate bonds have delivered exceptional returns last year and their relatively small yields leave little room for capital appreciation. The VCIT ETF generated a 16% return last year which is significantly above historical returns for the asset class.

Similarly, REITs have had a stellar run and jumped 28% last year. Real estate valuations are rich, and future rent may only grow in line with inflation. We still like these assets but the opportunity for stellar returns are diminished by their elevated valuations.

Interestingly, after the shift in our asset class allocation, the yield on the portfolio remains unchanged. The current yield on the DIAP as of January 3, 2019 is 5.3% annualized. The current investments have dividend yields ranging from 2.9% to 9.1%, compared to the S&P 500 dividend yield of 1.9% and 10-Year US treasury of 1.8%.

Lastly, it is important to reiterate the investment philosophy of the Dynamic Income Allocation Portfolio. The DIAP is designed to function as the core foundation of an investor’s portfolio by operating with the dual mandate of generating the highest current income possible while preserving capital.

Pelican Bay Capital Management attempts to achieve this dual mandate by only investing in asset classes that by themselves offer a current dividend yield that is greater than either the dividend yield of the S&P 500 or 10-year U.S. Treasury. In our view, elevated income can add stability to a portfolio and maximize the benefits of compounding through reinvestment.

We then construct a portfolio of these high-yielding asset classes with an emphasis on minimizing correlation of the overall portfolio and maximizing its diversification beyond the typical 60/40 stock/bond portfolio. We finally add a valuation overlay that we utilize across all our portfolios. We allocate a larger position weighting to the most undervalued and attractive investment opportunities, while avoiding owning overpriced assets.

Phoenix Fund

Please note: The Phoenix Portfolio is only available to “Qualified Clients” pursuant to section 205(e) of the Investment Advisors Act of 1940 and section 418 of the Dodd-Frank Act.

The Phoenix Fund had outstanding performance in the fourth quarter adding to the strong returns generated in September. The environment for risky assets has improved after facing difficult headwinds over the summer. The portfolio was up 13.3% in the quarter, widely outpacing the market.

Energy was the largest driver of returns, responsible for nearly half of our performance this quarter. Transocean jumped 54% in the quarter as oil prices moved higher and new contract awards for drilling rigs are being signed at higher than expected rates. We believe the oil majors will ultimately have to boost their investments in deep-water exploration and production as shale activity slows and conventional oil declines. The deep-water is the only place to economically find significant new oil reserves. Transocean is the largest player in the space with the best fleet. They have consolidated the industry and watched several competitors go bankrupt. There is a long way to go for this company’s share price if the oil market continues to gain steam.

Denbury, which is one of our larger Tier 1 positions, jumped 19% in the quarter. As we have discussed in prior letters, this company is dramatically undervalued. We believe fair value is somewhere between $6-10 per share. We estimate that the current stock price reflects an oil price of approximately $52 per barrel. As we write this letter WTI oil is trading hands for $63 per barrel. The disconnect is reflective of the overwhelming investor apathy for energy investments. The gap in valuation to prevailing oil prices will eventually attract investors and this gap will ultimately close.

The biggest contributor to our success this quarter was ADT, the largest home security provider in the US. The company has continued its rebound from a low this summer and at one point nearly doubled its share price. We did trim our position at $9.40, but ADT remains our largest holding in the Tier 1 bucket in the portfolio. The company also paid a one-time special dividend of $0.70 per share after the successful sale of their Canadian operations. We believe the stock is worth $9-15 per share. Apollo, one of the world’s largest Private Equity funds, is a majority owner with approximately 85% of the shares. We would not be surprised to see the Private Equity firm take the company back private as public markets have thus far not recognized the fair value of the company.

We had more success with Endo Pharmaceuticals this quarter after initiating the position only last quarter. Please see our last note for a detailed discussion of our investment thesis, but the short story is the opium litigation payments will be smaller than anticipated and spread out over a long time period, allowing Endo to avoid bankruptcy. With the stock up 47% this quarter, other investors are coming to similar conclusions. We trimmed a third of our position at $5.00 as the stock rebounded sharply from our purchase price. We will continue to exit if the stock moves higher. We think shares are worth $6-10, but the unknown outcome surrounding opioid litigation will keep our position on the smaller side of the Tier 2 bucket.

The environment for risk improved in September and October as investors re-focused their attention to fundamentals. We saw our investments respond positively. We leaned into strength and started deploying more capital. Cash, which was as high as 50% in early August, has dwindled down to 19% at the end of the year. Cash is on course to move lower in the first quarter as we are not having trouble identifying new investment opportunities.

The only downside to deploying capital in new ideas is that we are typically buying securities that are in distressed situations and being liquidated by their large institutional investors. Stocks tend to drift lower when we are building positions in new ideas. As you can see from the list of our bottom five contributors to our return, four of the stocks are new positions initiated in late December including: Freightcar America, Valhi, Venator Materials, and Evolent Heath. These were our only stocks in the Phoenix Fund that produced negative returns in the quarter.

The Derixion Small Cap Bear ETF was a hedge that we put in place during the finalization of the “Phase 1” Trade Deal between the US and China. Since talks collapsed the last two times discussions were being finalized, we thought it was prudent to protect the portfolio to avoid a repeat of the negative performance we experienced in each of those occasions. The total cost of the hedge was very reasonable at only 37 basis points.

Freightcar America (RAIL) is a manufacturer of railroad freight cars. The company has been struggling for many years. This is primarily because up until three years ago, they only manufactured coal hoppers. With the decline of coal demand for power use and shrinking coal mining, the industry will likely never need a new coal hopper. Recognizing the lack of any future needs for new coal hoppers, RAIL began making other rail car types. This has required substantial investment as they have had to invest in new car designs and build new manufacturing lines to make these new models. RAIL is nearing the end of this transition period and is finally able to produce other car types at a cost that will allow them to be competitive in the market. They are also consolidating manufacturing into a single plant in Alabama that will dramatically reduce costs.

Although RAIL has transitioned the business, their difficulties have been compounded as the Rail Industry has gone into a slump with declining freight volumes due to the trade war, poor crop growing conditions this summer, a slowdown in oil activity, and declining manufacturing activity. This has caused the industry to suspend new rail car orders. But this is the typical cyclical environment the industry operates in, and it will ultimately rebound. None the less, the cyclical slowdown didn’t make matters any better at RAIL.

The good news is RAIL has the balance sheet to complete their transition and survive for the eventual recovery in new railcar demand. The company has $63 million in cash and no debt. Further losses should be curtailed as they closed their last plant this quarter. For comparison, their entire market cap is only $27 million. They are one of the rare net-nets that Warren Buffett used to traffic in when he ran his own investment partnership. The stock could rebound by 140% if it only returns to its net cash balance. If the stock falls any more, we will increase our ownership position.

Valhi and Venator Materials are both smaller producers of Titanium Dioxide (TIO2). This is the primary chemical used in paint and industrial coatings. The sector is highly cyclical and falls in an out of favor as its demand collapses and recovers. Demand has been weak as the manufacturing economy has slowed over the last two years. Supplies of TIO2 have shrunken and Chemours, the largest player in the industry, is cutting capacity to improve pricing. We believe the TIO2 sector is beginning to recover as manufacturing activity rebounds and inventory levels have fallen well below normal levels. We think both stocks could double or quadruple as they have tremendous operating leverage to any rebound in TIO2 pricing.

Finally, we wanted to revisit the investment philosophy of the Phoenix Fund. The portfolio takes advantage of structural biases against institutional ownership of financially levered companies with low-stock prices. We seek companies that have had their stock prices fall 70% or more in the last two years and are priced below $10 dollars per share. This outcome typically leads to forced selling from their institutional shareholders, creating the opportunity to make outstanding investments for less constrained investors.

Generally, these companies are under distress from poor performance caused by what we believe are temporary factors. These companies typically have elevated levels of debt, and any prolonged period of business stress could cause stockholders to endure substantial losses. The Phoenix Fund is a high-risk, high-return investment strategy. Please see the Risk of Loss Section of Part 2A of Form ADV referenced below.