To view this letter in PDF Format lease click here: 2024-Q3 PBCM Investor Letter.pdf

Welcome to our new investors and thank you to our existing clients and partners for your continued support. We are pleased to present our results for the most recent quarter in the following pages.

After reading this letter, please do not hesitate to contact us if you have any questions, want to discuss any topics in greater detail, or would like to learn more about our Concentrated Value portfolio. We can be easily reached via e-mail at info@pelicanbaycap.com. We welcome your feedback and look forward to your correspondence. Additionally, we encourage you to share this letter with your friends and colleagues.

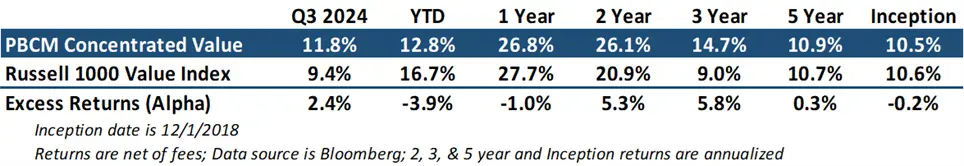

The dominance of the Magnificent Seven stocks waned during the third quarter of 2024, leading to improved market breadth. Value stocks surged, with the Russell 1000 Value Index gaining 9.4%. This environment favored high-quality companies that had underperformed year-to-date. Our Concentrated Value portfolio performed particularly well, rising 11.8% and reversing the underperformance experienced in the second quarter.

The fourth quarter has also started positively for the portfolio. While it’s still early, we’re optimistic that the Concentrated Value portfolio can close the performance gap relative to its benchmark by year-end. If successful, this would mark our fourth consecutive year of positive alpha generation.

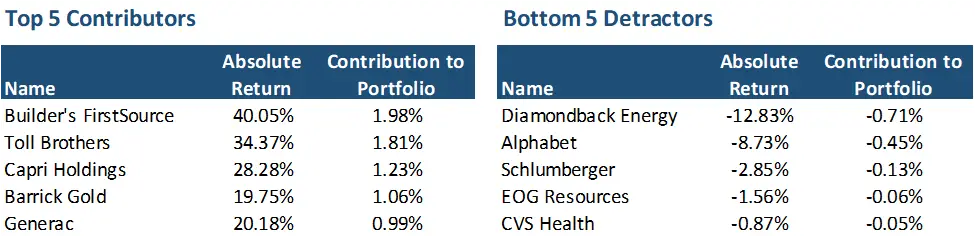

Our strong third-quarter results were driven by our Home Builders and Consumer Discretionary stocks. Companies like Builders FirstSource (BLDR) and Toll Brothers (TOL) rebounded significantly as interest rates declined, offsetting their weak first-half performance. As two of our largest holdings, their outperformance contributed to a 3.8% gain for the overall portfolio. The table below details the top five contributors and detractors to portfolio performance.

Capri Holdings (CPRI) also performed well during the quarter. Courtroom reports from their antitrust trial with the FTC indicated that the government’s case to block the acquisition was weak. The judge is expected to deliver a ruling in the coming weeks. While the trial seemed favorable for the merger, there’s a real risk that the judge, a 2022 Biden appointee, might defer to the government and rule in their favor, regardless of the FTC’s case strength.

Only five stocks generated negative returns this quarter. These were primarily our oil-related holdings, which declined in sympathy with falling oil prices in the third quarter. Both of our US shale oil producers, Diamondback Energy (FANG) and EOG Resources (EOG), decreased. FANG fell 13%, and EOG fell 2%. We had reduced our positions in both companies by a combined 300 basis points in early July, mitigating the negative impact on the portfolio from their subsequent share price declines.

Alphabet’s stock underperformed this quarter after strong gains in the first half of the year. Renewed concerns arose about the threat of AI to Google’s search monopoly and pending legal decisions surrounding their own antitrust case. The outcome of these legal proceedings will take years to materialize. We added to our Alphabet position in early October.

Our trading activity was more active than usual this quarter. In addition to trimming our positions in EOG and FANG, we increased our holdings in Cisco Systems (CSCO) and Ulta Beauty (ULTA) when their share prices dipped early in the quarter. Both companies have since experienced a rebound in their share prices.

We also decided to exit our positions in both Altria (MO) and CVS Health (CVS). We sold our stake in Altria due to concerns that the pace of volume declines in the legacy cigarette business was accelerating faster than anticipated as nicotine users switch to vaping and oral nicotine products.

Over the past 18 months, cigarette volumes have declined at an annual rate of 12-13%, significantly worse than the 7-8% rate of decline just two years ago. Altria is no longer able to offset these steeper volume declines with price increases.

Additionally, Altria’s non-cigarette business is struggling to gain traction. In the increasingly popular oral nicotine segment, Altria’s On! brand is growing at a decent rate but is being outpaced by Philip Morris’s Zyn product, which is emerging as a clear category leader.

Similarly, in the vape market, Altria’s NJOY brand is facing challenges. The vape market is overwhelmed by illegal, non-regulated competition that can sell products with sweet flavors at significant discounts to regulated products. Given the lack of enforcement from the FDA or local law enforcement, we expect unregulated vape products to further erode NJOY’s market share.

As Altria struggles to make headway in these categories and legacy cigarettes continue to decline, we believe future revenue growth and normal earnings power could decline. We estimate that normal earnings power could fall to $4-$5 per share, resulting in an updated intrinsic value range of $32-$50 per share.

We exited our position in Altria at $48. Overall, the modest share price appreciation combined with significant dividends resulted in decent gains for our portfolio.

We have also decided to exit our position in CVS. When we initially invested, we overestimated the company’s potential for normalized earnings power. We no longer believe that CVS can achieve earnings power of $8.00-$9.50 per share within the medium term.

Primarily, we misjudged the operating leverage in the Medicare Insurance business. The losses associated with rising medical expenses were significantly greater than our downside scenarios anticipated. These issues were exacerbated by the government’s decision to cap insurance premiums for both Medicare and Medicaid in response to higher inflation.

Furthermore, the company made two substantial acquisitions, Signify Health and Oak Street Health, totaling $18 billion in cash. We expected these acquisitions to contribute $0.25-$1.00 to earnings power. Unfortunately, they remain unprofitable and have required ongoing investments. As capital allocation is a critical aspect of company management, the disappointing execution of these acquisitions has diminished our confidence in their ability to create shareholder value. Coupled with the mismanagement of the Insurance business, we have lost faith in management and have chosen to move on.

Finally, we initiated a new position in Schlumberger (SLB), the leading oil services provider with $35 billion in revenue. SLB is poised to be the primary beneficiary of increasing upstream E&P spending as major Integrated Oil companies like Exxon, Shell, and Chevron, along with State-Owned Energy Companies, intensify their focus on expanding deepwater and conventional oil and gas projects. This renewed interest in investing in conventional greenfield energy projects follows a decade of underinvestment in exploration and development.

During this period of underinvestment, incremental oil growth has been largely driven by increased short-cycle, less capital-intensive US shale oil production. However, we are witnessing signs of plateauing US shale oil production, indicating that future incremental oil demand will likely need to be met through new deepwater and international projects. This shift away from US Shale production towards conventional oil projects aligns with SLB’s strengths. The company is also a leading service provider for mega-gas projects in the Middle East and Asia.

The decade-long industry downturn has streamlined the competitive landscape to SLB’s benefit. Through strategic consolidation and continuous investment in innovative technologies, SLB has successfully widened its competitive moat compared to its peers in the oil services market.

We anticipate SLB can achieve low double-digit revenue growth over the next several years. Additionally, we believe the company can maintain operating margins between 15-20% while generating 10% or higher returns on invested capital throughout the upcoming upstream oil & gas investment cycle.

Despite SLB’s market-leading position and accelerating top-line growth, the shares are trading at their lowest valuation metrics since the oil-service downturn of 2016-2018 or the depths of the Pandemic in 2020. Currently, shares are trading at just 10.5x forward earnings estimates of $4.10 per share for 2025.

Our estimates for normalized earnings power range from $3.10 to $4.80 per share. Considering SLB’s dominant market position, high-teen profit margins, low-teen revenue growth, and moderate leverage of 1.0x net debt-to-EBITDA, we believe an appropriate valuation multiple for SLB shares is 16-20x estimated earnings. This would result in an estimated intrinsic value range of $50-$96 per share. We initiated our position at $43.

Lastly, we wanted to revisit the Investment Philosophy of the Concentrated Value portfolio. We utilize a value investment strategy that seeks out companies for investment which the Portfolio Manager deems to be high quality companies. Quality is defined by possessing business operations with durable competitive advantages, allowing for high returns and growing cash flows streams. We want these high-quality companies to also have solid balance sheets, preferably with a net cash position. We also prefer that their management teams make decisions with an emphasis on maximizing shareholder returns.

Once we find these high-quality companies, we generally only invest in their stock if they trade at a steep discount to our estimate of their intrinsic value. This is necessary to provide our investors with the opportunity to generate an above-market return and protect capital. This discipline creates a wide margin of safety if an undesirable scenario plays out in the future. Pelican Bay Capital Management believes that identifying a significant difference between the daily market value of a security and the intrinsic value of that security is what defines an investment opportunity.