To view this letter in PDF Format lease click here: 2025-Q2 PBCM Investor Letter.pdf

Welcome to our new investors and thank you to our existing clients and partners for your continued support. We are pleased to present our results for the most recent quarter in the following pages.

After reading this letter, please do not hesitate to contact us if you have any questions, want to discuss any topics in greater detail, or would like to learn more about our Concentrated Value portfolio. We can be easily reached via e-mail at info@pelicanbaycap.com. We welcome your feedback and look forward to your correspondence. Additionally, we encourage you to share this letter with your friends and colleagues.

The Concentrated Value strategy returned 5.89% this quarter, outperforming the Russell 1000 Value Index by 3.79%. After trailing by a wide margin in the prior two quarters, the portfolio rebounded, with many of our stocks that previously underperformed seeing a sharp recovery. This performance helped us meaningfully reduce our year-to-date deficit relative to the benchmark. We are also pleased to report that this strong relative performance has continued into the first two weeks of July.

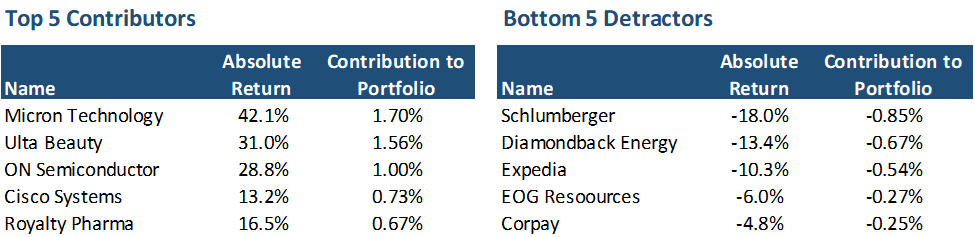

Our technology stocks were the primary drivers of our performance during the second quarter. Notably, our two semi-cap stocks, Micron (MU) and On Semiconductor (ON), saw significant jumps of 42% and 29%, respectively. Other tech stocks, including Cisco Systems (CSCO), also performed well. Ulta Beauty (ULTA) and Royalty Pharma (RPRX) contributed positively due to strong earnings reports. You can find a list of the portfolio’s top contributors and detractors in the table below.

Conversely, our energy-related companies were the weakest performers this quarter, with all three landing on our list of the bottom five detractors. Oil prices fell sharply during the quarter due to heightened trade barriers, which raised concerns about slower economic growth. Schlumberger (SLB) was our worst performer, falling 18%. We increased our position in SLB during its weakness and continue to believe the company is worth $50-$96 per share. SLB is currently trading for $36 per share, which is a substantial discount to our estimated intrinsic value.

This quarter saw elevated trading activity due to a spike in volatility in April. We welcome periods of heightened market anxiety, as market corrections present valuable opportunities for portfolio managers to enhance their portfolios with better investment prospects. The ability to recycle funds into beaten-down companies lays the groundwork for sustained outperformance into the subsequent market recovery. Our historical trading activity reflects this, with the Concentrated Value portfolio typically experiencing the most turnover during periods of market stress, including the Covid pandemic, the 2022 Russian invasion of Ukraine, and the Silicon Valley Bank Crisis in March 2023.

As market sentiment began to deteriorate in early April, we initially trimmed our holdings in CBOE and CME, as both stocks were trading slightly above our intrinsic value estimates. We also exited our Verizon (VZ) position to free up cash for a new investment.

Even before the market turbulence hit, we had been contemplating selling Verizon for several months. We initially became concerned when Verizon announced the acquisition of Frontier Wireless and plans for extensive capital investment in their fiber network. Our original thesis was that capital expenditures (CAPEX) would decline, and earnings would rise above $5 per share as the company completed its 5G network deployment. The Frontier acquisition directly challenged this thesis.

Our fears were confirmed in early April when Verizon announced a three-year rate freeze for all customers, including existing ones. This will significantly restrain average revenue per user (ARPU) growth and should drive EPS down to $4 per share. Combined with an additional $20 billion in debt from the Frontier deal, we decided it was time to sell our shares for $45.

We had originally reduced our Expedia (EXPE) position in early March as the stock reached the middle of our fair value estimate following a strong fourth quarter earnings report. However, in the subsequent weeks we began to worry that government spending cuts and a deterioration in both business and consumer confidence were disproportionately impacting the travel industry.

In late April, after observing significant declines in real-time analytics for airline tickets and hotel bookings, we expected Expedia would have to significantly reduce its outlook when it reported earnings in May. Given the deteriorating travel outlook and expectations for negative reactions in the near term we decided to fully exit our Expedia position and pursue a better investment opportunity.

Despite Expedia being a good company with further upside potential, we thought shares could fall significantly if the economic outlook continued to diminish. Travel is often the first discretionary purchase canceled during periods of economic stress by both consumers and businesses, and Expedia has historically underperformed significantly during economic slowdowns. Ultimately, our investment in Expedia was a pleasant experience and we sold on success, as we originally purchased our position in June 2023 for $98 and sold our last shares for $151.

During the market drawdown we also began to redeploy our cash. We added to our positions in Builders FirstSource (BLDR), Schlumberger, and Generac (GNRC). We also initiated a new investment in liquor producer Brown-Forman Company (BF.B).

Over the past year and a half, the alcoholic beverage industry has lost favor with investors. Sales and unit volumes have fallen by 1-2% after booming during the COVID-19 pandemic, leading to concerns that alcohol usage may be in a new secular decline.

The prevailing narrative supporting this view is three-fold:

- Gen Z is “health conscious”: This cohort is believed to drink less than previous generations.

- GLP-1 weight loss drugs: These drugs are thought to be curbing alcohol usage.

- Increasing cannabis usage: Legalization efforts in various states are perceived as taking market share from alcohol.

While it’s fair to acknowledge these factors may have some merit, we believe there’s no strong evidence to suggest they are significant enough to cause a 5-6 point decline in liquor sales.

For example, Gen Z consumers are experiencing a broad decline in spending. According to a Circana report, spending by 18-24 year-olds on video games, apparel, and beauty is down 24%, 12%, and 10% respectively. Frankly, Gen Z consumers are bearing the brunt of macro headwinds. Another study from Statista Consumer Insights found that 18% of Gen Z regularly consumes spirits, which is consistent with older generations: Baby Boomers (18%), Gen X (19%), and Millennials (22%). The lower alcohol consumption among Gen Z is entirely confined to beer and wine usage.

Alternatively, we believe the pause in spirits growth is a normal cyclical slowdown driven by inflation and macroeconomic weakness, which particularly impacts consumers with less disposable income, such as the Gen Z cohort. This pause is also a healthy recalibration following the significant growth in alcohol, especially spirits volumes, during the 2021-2023 COVID-19 period. Looking at volume growth over a five-year period, spirits sales grew at a 4-5% compound annual growth rate (CAGR), which aligns with historical long-term growth rates.

We believe the spirits industry could remain under pressure in 2025 due to continued economic weakness, changing tariff regimes, and elevated inventories in wholesale channels and personal at-home liquor cabinets. However, we expect the spirits industry to return to its long-run growth rate as the economy improves, spirits continue to gain market share from beer and wine, and the global population increases and ages. Over the next six years, approximately 600 million new legal-purchase-age consumers are expected to enter the global spirits market.

Fears over the structural collapse of the spirits industry have created a tremendous opportunity for investors. We have long admired Brown-Forman as one of the top liquor companies with world-class brands. They hold a dominant position in the American Whiskey category with brands like Jack Daniel’s and Woodford Reserve, as well as the Herradura label in the Premium Tequila category. The company is a compounder, delivering 32% operating margins over the last decade and a nearly 40% Return on Equity (ROE). They also boast an excellent balance sheet and a generous dividend policy with an attractive 3.5% yield.

Amazingly, Brown-Forman’s stock price has fallen by 62% in the last two years, while its price-to-earnings (P/E) ratio has dropped to 15x. The last time Brown-Forman traded this cheaply was during the depths of the great financial crisis in 2009. We have never had an opportunity to own the company, as it has consistently traded at rich valuations above 25x earnings.

We ultimately believe the spirits industry will return to its long-run growth rate, with whiskey and tequila continuing to gain share in spirits and prices rising due to a shift toward premiumization. These tailwinds should drive 4-5% growth in Brown-Forman’s U.S. business, while international sales accelerate at a 5-7% pace. Gross margins should expand back to pre-COVID levels of 63-67% from the post-COVID 60% level as the company increases international distribution, outsources barrel-making operations, rationalizes inventory, and increases its mix of premium sales. We believe this should boost operating margins to 32-36%, resulting in normal earnings power of $2.15-$2.50 per share.

Given their brand portfolio, high returns on capital, and solid balance sheet, we believe an appropriate multiple for Brown-Forman is 18-23x normal earnings power, resulting in an intrinsic value of $39-$57 per share. We initiated our position at a price of $25.84 per share, representing a significant discount for a company of this quality.

We currently have 19 positions in the portfolio and are looking to add a 20th investment to bring the strategy back to a fully invested position. We’re on the hunt for another company that meets our strict criteria, and we hope to have a new investment to share with you in our upcoming Q3 investor letter.

Lastly, we wanted to revisit the Investment Philosophy of the Concentrated Value portfolio. We utilize a value investment strategy that seeks out companies for investment which the Portfolio Manager deems to be high quality companies. Quality is defined by possessing business operations with durable competitive advantages, allowing for high returns and growing cash flows streams. We want these high-quality companies to also have solid balance sheets, preferably with a net cash position. We also prefer that their management teams make decisions with an emphasis on maximizing shareholder returns.

Once we find these high-quality companies, we generally only invest in their stock if they trade at a steep discount to our estimate of their intrinsic value. This is necessary to provide our investors with the opportunity to generate an above-market return and protect capital. This discipline creates a wide margin of safety if an undesirable scenario plays out in the future. Pelican Bay Capital Management believes that identifying a significant difference between the daily market value of a security and the intrinsic value of that security is what defines an investment opportunity.