To view this letter in PDF Format lease click here: 2025-Q3 PBCM Investor Letter

Welcome to our new investors and thank you to our existing clients and partners for your continued support. We are pleased to present our results for the most recent quarter in the following pages.

After reading this letter, please do not hesitate to contact us if you have any questions, want to discuss any topics in greater detail, or would like to learn more about our Concentrated Value portfolio. We can be easily reached via e-mail at info@pelicanbaycap.com. We welcome your feedback and look forward to your correspondence. Additionally, we encourage you to share this letter with your friends and colleagues.

The Concentrated Value strategy had a strong quarter, generating a total return of 7.8%. This delivered 2.5% of alpha relative to our benchmark, the Russell 1000 Value Index. After underperforming the benchmark by -4.8% in the first quarter of the year, we were extremely pleased to have closed that deficit and pulled nearly even with the benchmark for the year. Though it’s still early in the fourth quarter, the Concentrated Value strategy has already pulled ahead of the Index on a year-to-date basis.

Our recovery versus the Index was primarily driven by gains in gold miners and technology stocks. Notably, Barrick Mining (our second-largest position at the beginning of the quarter) jumped 60% and contributed 3.4% to the portfolio’s quarterly return. The gold miners benefited from heightened investor excitement as the underlying bullion price increased 17% in Q3. As we’ve noted in prior letters, gold miners’ stock prices had lagged the increase in gold prices this year, and investors finally seem to be recognizing this disconnect. Despite the strong gains in Barrick’s share price, we believe the current stock price still reflects an underlying gold price of $3,000-$3,400 per ounce, which is well below the current spot price of $4,300 per ounce.

Technology stocks were also outperformers in Q3. Micron (MU) benefited from a second consecutive quarter of excellent gains, jumping another 36% after last quarter’s 42% increase. On a year-to-date basis, Micron is up 99%. Investors have recognized that the inference and agentic applications of AI computing are poised to drive significant orders for the High Bandwidth Memory (HBM) that Micron produces. To learn more about the need for HBM memory please refer to our Q4 letter from 2024.

Alphabet (GOOG) gained 41% this quarter as they also benefited from increasing demand for their AI services. GOOG’s Gemini AI app has recently surpassed OpenAI’s ChatGPT app in the Apple app store, and the company’s Tensor Processing Chips have become a viable alternative to Nvidia’s GPUs in Data Center’s dedicated to AI use. I would note that GOOG’s stock price has increased to the top end of our estimated intrinsic valuation range, and we have trimmed our position meaningfully.

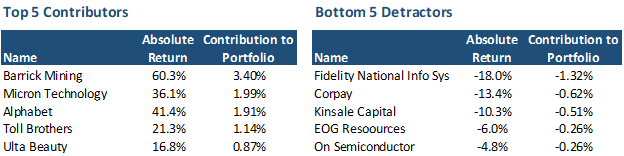

Toll Brothers (TOL) and Ulta Beauty (ULTA) rounded out our list of top 5 contributions to the portfolio’s return this quarter. You can find a list of the portfolio’s top contributors and detractors in the table below.

Fidelity Information Systems (FIS) was the largest detractor in performance this quarter. Shares declined following a poorly received earnings report that included an outlook too conservative compared to expectations. We continue to believe the company is significantly undervalued and we added to our position after the share price drop.

Corpay (CPAY) declined amid investor concerns that labor market weakness is weighing on its corporate payments business. CPAY also operates a large truck-fleet fuel card business, which is under pressure from the significant decline in U.S. freight volumes. However, this industry weakness provided us an opportunity to invest in the segment leader, which we discuss below.

EOG Resources (EOG) landed on our list of detractors for the second consecutive quarter as energy prices continued their decline. We added to both EOG and Diamondback Energy (FANG) as their share prices languished with falling crude oil prices.

Kinsale (KNSL) shares fell 10% this quarter. The decline was driven by challenges in the Excess and Surplus (E&S) insurance market, which is facing increased competition and lower insurance premiums. Consequently, the company’s rapid pace of policy growth over the last four years is expected to decelerate in the coming quarters.

Furthermore, our due diligence uncovered that Kinsale recently lost two court cases resulting in significant financial damages awarded to clients. While Kinsale has appealed both verdicts, management has not reserved for these potential losses. Though not an incorrect accounting practice, this is less conservative than we prefer, as losing just one of these appeals could materially impact the company’s earnings. We note that neither the company nor Wall Street analysts have publicly acknowledged these cases.

Although we admire Kinsale’s leading position in the E&S market, we believe the stock would decline significantly if the company loses its appeals, at which point management would be compelled to disclose the adverse verdicts. Given the binary nature of this outcome and management’s decision not to book reserves after the initial losses, we decided to sell our shares for a small loss.

We replaced Kinsale with Old Dominion Freight Lines (ODFL), the undisputed leader in the Less-Than-Truckload (LTL) freight market.

The trucking industry is notoriously competitive and prone to cyclicality. Despite this, over the last three decades, ODFL has built a business with significant competitive advantages protected by real moats.

While most peers struggle to generate a profit, ODFL maintains 20% operating margins and a high 20%+ return on invested capital (ROIC), all while keeping a net cash balance sheet. More importantly, the company is known as the only consistently reliable player in the LTL industry, which allows it to charge a premium price for its service.

This higher pricing power gives ODFL the ability to invest more than peers in its network infrastructure across the economic cycle, including during down markets when other trucking companies must cut capital spending. This willingness and ability to invest through the cycle is the critical differentiator between ODFL and its competition.

History proves this strategy supports ODFL’s capability to win significant market share when the economy is strongest. Essentially, the company has created a beneficial circular feedback loop that strengthens its competitive advantages versus peers with each passing trucking market cycle.

The key to ODFL’s success is not a secret, and two companies known for their excellent management teams have pledged to duplicate ODFL’s “invest through the cycle” strategy. However, as we find ourselves two years into a difficult freight recession, it is clear that these competitors (Knight-Swift and XPO) have not been able to generate the profits necessary to sustain regular capital investments. Both have reverted to price concessions to maintain enough freight volume to remain profitable. This gives us more confidence that no competitors will match ODFL in the near term, allowing them to maintain their pricing power and profit margins and continue to take market share when the cyclical freight market ultimately recovers.

As the LTL market recovers, ODFL should generate $6-8 per share in EPS, resulting in an intrinsic value of $132-200 per share. It is a rare opportunity to buy a compounder like ODFL near the low end of its valuation range. We acquired our initial investment at $141 per share.

This quarter we also initiated a new position in Elevance Health (ELV), a leading health insurance company with over 45 million members, operating through its well-known brands: Anthem Blue Cross Blue Shield for private employers and Wellpoint for Medicare and Medicaid plans. A key competitive advantage is its in-house pharmacy benefit manager (PBM), Carelon.

ELV has been one of the better operators in the insurance business. Unlike many other competitors who pursued growth at any cost in recent years, ELV has maintained disciplined pricing and elevated underwriting standards, even shedding members when competition intensified. The company’s organic investments and acquisitions have delivered double-digit ROIC, strong free cash flow, and consistent capital returns through dividends and buybacks. Unlike many of their peers, ELV did not compromise their balance sheet with dilutive acquisitions. ELV has a net cash position of $4.5 billion.

The health insurance industry has faced significant pressure this year. Profitability in Medicaid and Medicare has weakened due to aggressive pricing from competitors like CVS and UnitedHealth (UNH), as well as higher-than-expected utilization of behavioral health, GLP-1 drugs, and elective surgeries. While ELV maintained more rational pricing and even declined some Medicare business, it was not immune, lowering EPS guidance by 13% or about $5 per share.

Additionally, investor sentiment soured on the sector following allegations of Medicare Fraud and illegal claims denial practices at UNH, the industry’s bellwether. The major Health Insurance companies fell 30-50% following these revelations in April. ELV was not spared and fell nearly 40% from peak to trough. Based on our due diligence, we believe the misconduct is isolated to UNH and stems from their aggressive corporate culture and management incentives that demanded an imposing EPS growth rate target of 14-16% per year. In fact, we believe ELV is poised to win market share in the multi-state private insurance business as large corporations renewing their insurance contracts seek alternatives to UNH. There are only three major players in this market including ELV.

Looking ahead, we expect Medicare and Medicaid profitability to normalize as multiple insurers raise pricing by 20–25% in 2026. ELV is well-positioned to recover lost earnings power and increase EPS by low double-digit rates. As the Medicare business rebounds and private insurance business takes share, we believe normal earnings power over the next few years will be $34-$40 per share.

Thus, the recent weakness in ELV has created a tremendous buying opportunity as we acquired our shares for $310. As the fog around the UNH fraud clears and investor confidence in the insurance industry taking better control of medical cost increases, we would expect the multiples for this business to improve. We think a 13-15x valuation multiple is appropriate for ELV, resulting in an intrinsic valuation range of $440-600.

Lastly, we wanted to revisit the Investment Philosophy of the Concentrated Value portfolio. We utilize a value investment strategy that seeks out companies for investment which the Portfolio Manager deems to be high quality companies. Quality is defined by possessing business operations with durable competitive advantages, allowing for high returns and growing cash flows streams. We want these high-quality companies to also have solid balance sheets, preferably with a net cash position. We also prefer that their management teams make decisions with an emphasis on maximizing shareholder returns.

Once we find these high-quality companies, we generally only invest in their stock if they trade at a steep discount to our estimate of their intrinsic value. This is necessary to provide our investors with the opportunity to generate an above-market return and protect capital. This discipline creates a wide margin of safety if an undesirable scenario plays out in the future. Pelican Bay Capital Management believes that identifying a significant difference between the daily market value of a security and the intrinsic value of that security is what defines an investment opportunity.

I would like to give a special thank you to our analyst Isabella Arias. She contributed to this quarter’s Investor letter by providing the writeup for Elevance Health.