To view this letter in PDF Format lease click here: 2024-Q2 PBCM Investor Letter.pdf

Welcome to our new investors and thank you to our existing clients and partners for your continued support. We are pleased to present our results for the most recent quarter in the following pages.

After reading this letter, please do not hesitate to contact us if you have any questions, want to discuss any topics in greater detail, or would like to learn more about our Concentrated Value portfolio. We can be easily reached via e-mail at info@pelicanbaycap.com. We welcome your feedback and look forward to your correspondence. Additionally, we encourage you to share this letter with your friends and colleagues.

As value investors, at our core, we believe that buying companies that we consider to be of higher quality than average and whose share prices are selling at a discount to our estimated intrinsic value should result in attractive absolute returns over time.

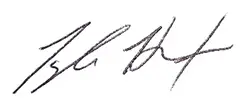

However, as portfolio managers, we must deliver these returns relative to competing money managers as well as a benchmark of companies that comprise the opportunity set for our investments. In the case of the Concentrated Value portfolio, we strive to produce returns exceeding the Russell 1000 Value Index that comprises large-cap value stocks.

To increase the possibility of constructing a portfolio that can outperform the benchmark over an investment cycle, we believe it is necessary to employ a concentrated approach. There are three reasons for this.

First, as the number of holdings increases in a portfolio, the closer the portfolio will resemble the index and the potential active share measure of the portfolio declines. Active share is a statistical measure that calculates the difference between a portfolio’s holdings and its benchmark index. The lower the active share, the more the portfolio resembles the index, and the more difficult it becomes to deliver differentiating returns.

Second, concentration results in each individual stock position having a greater influence on the portfolio. Therefore, if we correctly identify a company whose stock price increases, the larger impact those positive results will have on the overall portfolio.

Third, as it pertains to our investment philosophy, the high-quality companies we seek to buy do not regularly trade for large discounts to their underlying values. A great company may only trade for a price below its intrinsic value once every 3 or 4 years, sometimes much longer. As the number of holdings in a portfolio increases, the portfolio manager will inevitably need to make tradeoffs such as loosen their investment criteria when buying a new stock or delaying the sale of overvalued companies.

Of course, there are no free lunches in investing and there are tradeoffs commensurate with any benefit. The tradeoff for managing a concentrated portfolio is the potential higher volatility and periods of negative alpha. For example, a handful of stocks in the portfolio can be simultaneously hit by negative events, such as an unfavorable earnings report or industry specific slowdown.

Unfortunately, in the second quarter, this very scenario impacted the Concentrated Value Portfolio, which fell -6.3% compared to -2.2% decline in the Russell 1000 Value Index. We will discuss the individual impacts in the portfolio commentary below.

While we were disappointed in our absolute and relative results this quarter, we continue to very much like the companies in our portfolio and believe many of the poor results this quarter will prove temporary.

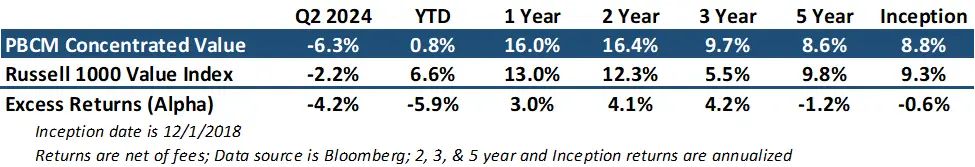

In fact, when we analyze the metrics of the portfolio in the table below, we can see that on average the companies in the Concentrated Value Portfolio have higher operating margins and returns on invested capital than the typical company in the index. They also have significantly less leverage than the companies in the index. All hallmarks of high-quality companies.

Most importantly, these high-quality companies trade for just 13.5x forward price-to-earnings multiple, a meaningful discount compared to the Russell 1000 Value Index forward multiple of 16.3x. Over time, we believe these higher-quality companies should trade at a premium to the market. This transition in valuation from a discount to a premium should generate a superior return to the benchmark if the underlying companies in our portfolio maintain their superior business models.

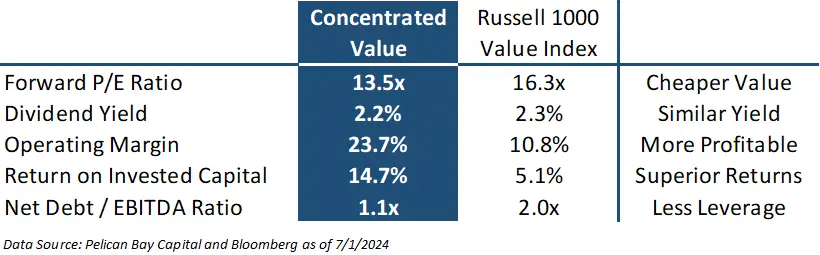

Turning back to the short term, our underperformance this quarter was mostly the result of a difficult earnings reporting season where investors in general punished any unsatisfactory results. In particular, the quarterly results from Builders FirstSource (BLDR), CVS Health (CVS), and Corpay (CPAY) were particularly negatively received. Comparatively, the number of companies in the portfolio that jumped on positive surprises was limited to Alphabet (GOOG).

Additionally, investor concerns regarding potential regulatory hurdles for Tapestry’s (TPR) acquisition of Capri (CPRI) caused CPRI’s share price to decline -27% to just $33 as the Federal Trade Commission (FTC) sued to block the deal in May. The stock is now trading well below the proposed acquisition price of $57 per share.

We continue to believe that the FTC’s case lacks merit as the combination of Capri-Tapestry does not come close to exceeding any of the standard legal tests applied in antitrust cases. The FTC is arguing a novel antitrust theory as they attempt to legislate through the courts. However, at the current price, Capri appears to be significantly undervalued and we would be acquiring shares here if we were not already shareholders. We believe there is substantial upside to Capri if it must continue as a stand-alone entity. We view the lawsuit with the FTC as a free call option that represents material upside in the near-term should Tapestry and Capri win the case.

Our homebuilding-related holdings have delivered a sting of strong returns over the last several quarters, and we are not surprised to see them give back some of that outperformance. In fact, we welcomed the weakness in Builder’s FirstSource (BLDR), as it allowed us to repurchase the shares we had sold in April at $187 per share for only $141 in June. As of this writing, the share price for BLDR has rebounded to $163. We believe shares are worth $130-$200.

In addition to our activity in BLDR we also trimmed Alphabet (GOOG) at $174 as it moved into the upper half of our intrinsic value range following a strong earnings report. Conversely, we added to our positions in CVS and Expedia (EXPE) as their shares sold off following their quarterly earnings reports.

EXPE disappointed shareholders as their profit margins expanded less than expected as higher advertising expenses offset cost savings from their IT systems consolidation. There is clearly apprehension amongst investors that EXPE can deliver on their operating margins targets. We continue to believe that the company will be able to increase operating margins to at least 20% from their historical range of 14-16%. Combined with revenue growth of 5-9%, the stock appeared attractively priced at $116 per share. At the time of this writing, shares of EXPE have rebounded to $132.

Finaly, we initiated a new position in Ulta Beauty (ULTA), which we will discuss in detail below. This purchase brings the portfolio back to 20 stocks and we are now fully invested with less than 1% of the portfolio currently in cash.

Ulta Beauty is the leading specialty retailer of cosmetics and hygiene products with over $11 billion in sales, representing a 10% market share in the US. Ulta has 1,395 stores in off-mall locations such as strip malls and standalone locations. The company is benefiting from tailwinds in the cosmetic industry along with share gains from department stores and pharmacies. These outlets combined are still 2x larger than Ulta, leaving plenty of room for further growth.

Ulta has continuously taken share from non-specialty retailers as they carry a much wider assortment of brands and products versus their competitors which are primarily mass merchants like Walmart, pharmacies, department stores and grocery stores. The company has a loyalty program with more than 43 million members that provides the company with consumer data and insights that create a competitive advantage versus non-specialty retailers, as they can deliver beauty focused marketing promotions. The industry has been somewhat immune from the “Amazon effect”, as shoppers prefer to explore new product offerings in physical stores.

Recently, shares have come under pressure due to investor concerns about increasing competition from Sephora, another specialty retailer. Sephora has expanded rapidly in recent years, thanks to a partnership to expand to 1,000 in-store locations at Kohl’s. Sephora’s partnership with Kohls has resulted in a near-term declaration in Ulta’s sales growth rate. However, with the Sephora rollout complete, we expect Ulta’s growth rate to return to normal levels of 5-7%, comprised of 3% same stores sales growth and 3-4% new store count.

Ulta has no debt and throws off substantial free cash flow which they are directing to share repurchases (they have bought back 20% of shares outstanding since the end of 2018). At current prices, share repurchases should reduce share count by 5% annually. When combined with 5-7% revenue growth and flat operating margins, Ulta should deliver earnings growth above 10% annually.

Shares currently trade for just 14x forward earnings, which is well below their historical average of 21x and our range of 18x-21x. Over the next few years, we believe that Ulta can generate normal earnings power of $27-$31 per share representing an intrinsic value of $480-$650 per share. We initiated our position at $382.

Lastly, we wanted to revisit the Investment Philosophy of the Concentrated Value portfolio. We utilize a value investment strategy that seeks out companies for investment which the Portfolio Manager deems to be high quality companies. Quality is defined by possessing business operations with durable competitive advantages, allowing for high returns and growing cash flows streams. We want these high-quality companies to also have solid balance sheets, preferably with a net cash position. We also prefer that their management teams make decisions with an emphasis on maximizing shareholder returns.

Once we find these high-quality companies, we generally only invest in their stock if they trade at a steep discount to our estimate of their intrinsic value. This is necessary to provide our investors with the opportunity to generate an above market return and protect capital. This discipline creates a wide margin of safety if an undesirable scenario plays out in the future. Pelican Bay Capital Management believes that identifying a significant difference between the daily market value of a security and the intrinsic value of that security is what defines an investment opportunity.